View Other Articles

Claims administrators owe penalty and interest on all late bill payments. Labor Code § 4603.2 mandates that claims administrators must self-execute penalty and interest. For more information, see the FAQ: Penalties and Interest for Late Payments.

However, claims administrators often ignore penalty and interest requirements. Therefore, we suggest incorporating penalty and interest language into Second Reviews. You can request penalty and interest on the Second Review for late payments on all bills–even those paid in full.

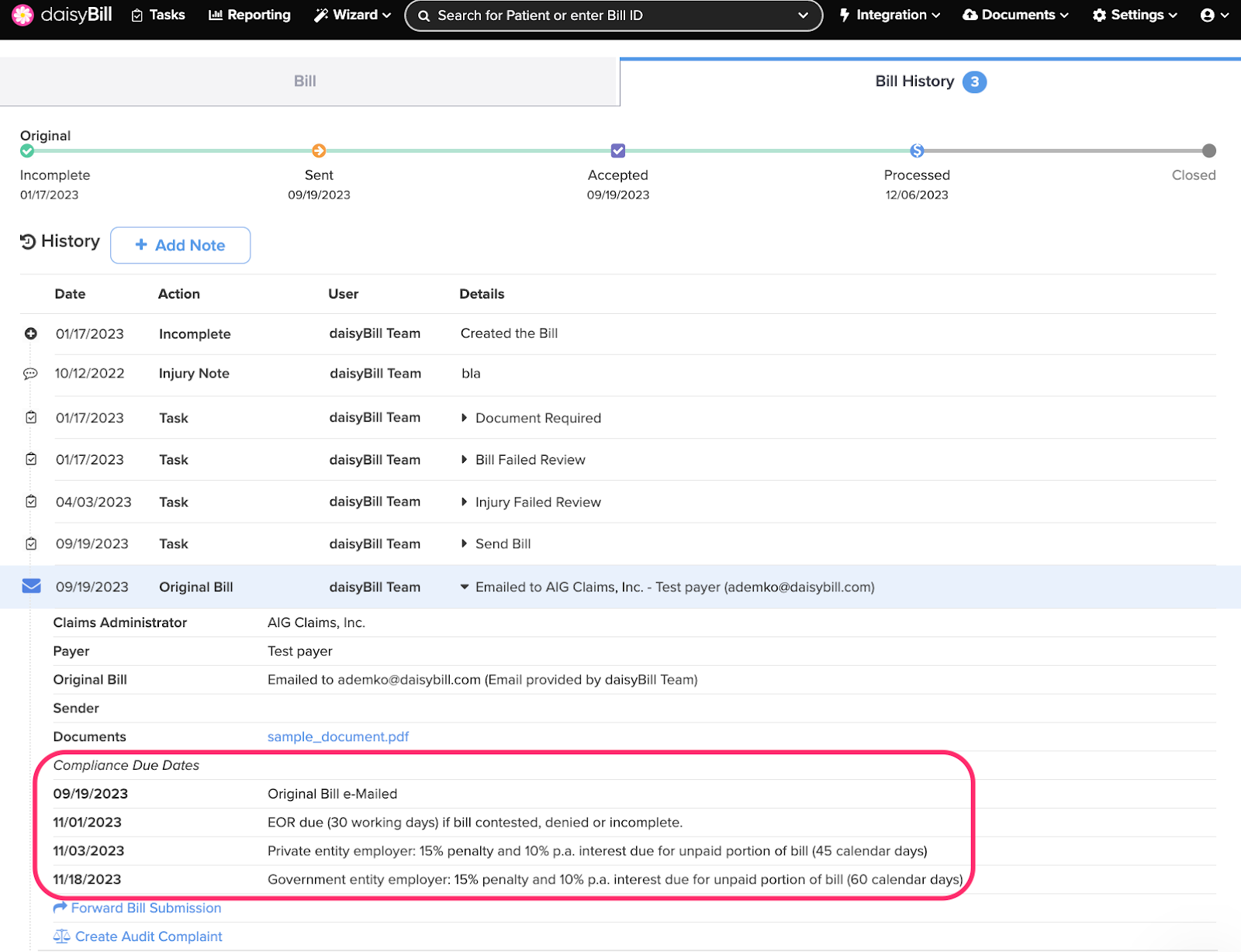

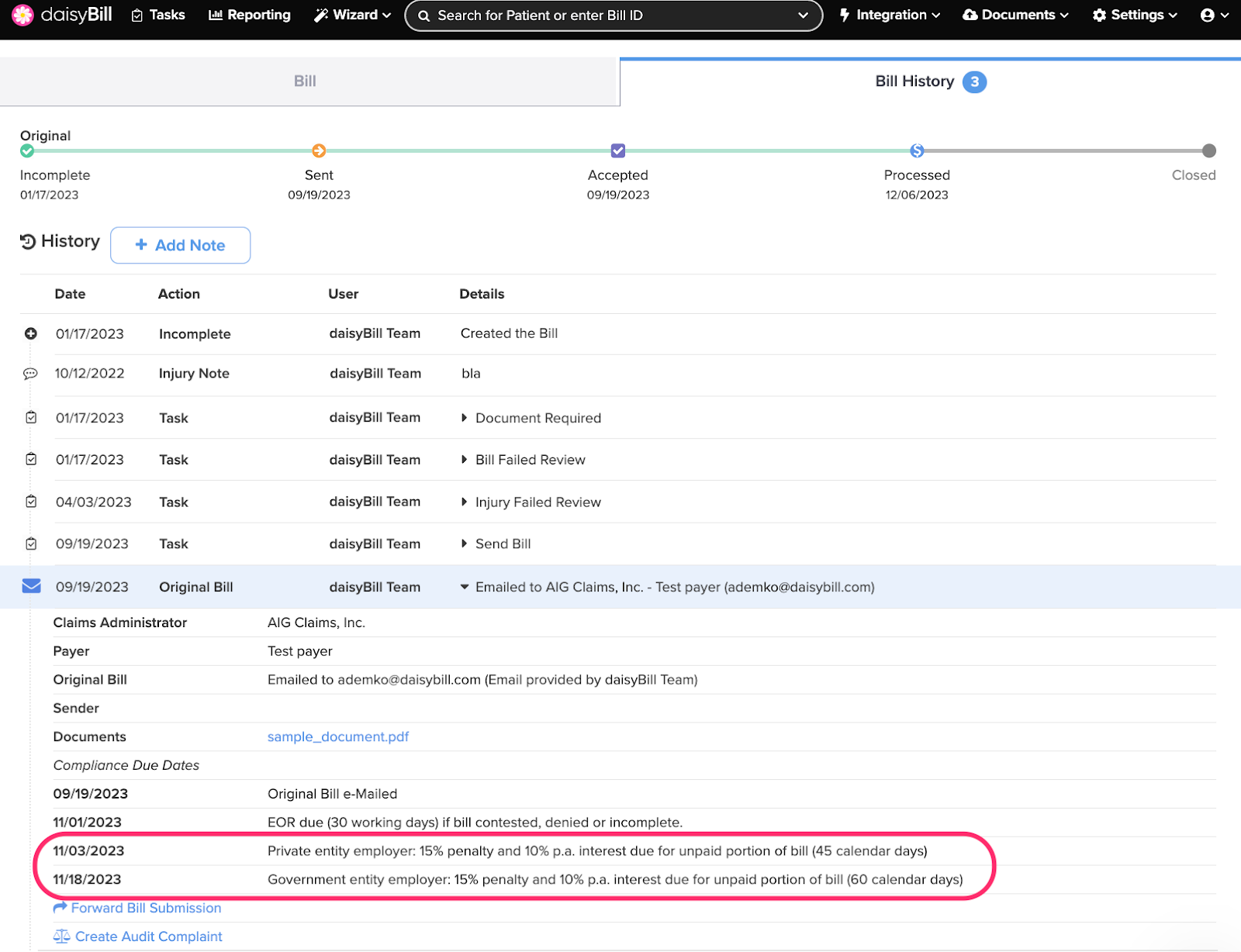

Use Bill History to keep track of accrued penalty and interest on late bill payments. Click on the submission, highlighted in blue, to expand and view penalty and interest due for a bill.

We hope that helps!