When manual or electronic reimbursement is posted to a bill, daisyBill automatically moves the Bill to Processed status, generates a Payment EOR task and assigns the task to a designated user.

This means the payer adjudicated (processed) the original bill, and payment was issued.

So what’s next? Determine if additional funds are due.

Watch Payment EOR tasks closely. For incorrect reimbursements, timely completion of Payment EOR tasks guarantees submission of Second Bill Reviews (SBRs) within the mandated 90-day timeline.

Here’s how to follow up on Payment EOR tasks.

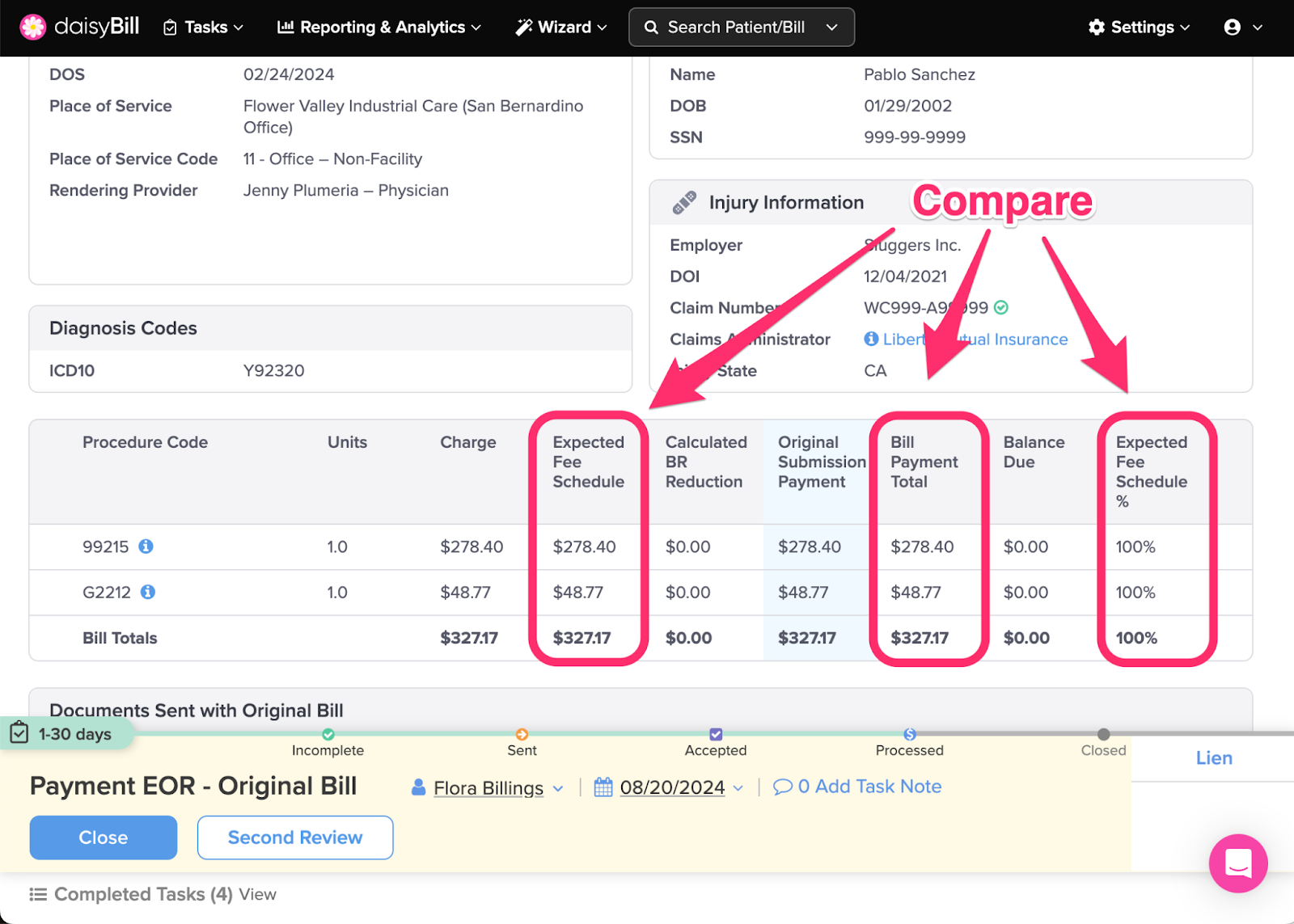

Step 1. For each Procedure Code, compare the ‘Expected Fee Schedule’ amount to the ‘Bill Payment Total’

Expected Fee Schedule: DaisyBill calculation of state fee schedule (for supported states), or, Organization's set Expected Reimbursement.

Bill Payment Total: Total of all payments posted to all submissions of the bill.

Expected Fee Schedule %: Bill Payment Total divided by Expected Fee Schedule.

Balance Due: Expected Fee Schedule less Bill Payment Total.

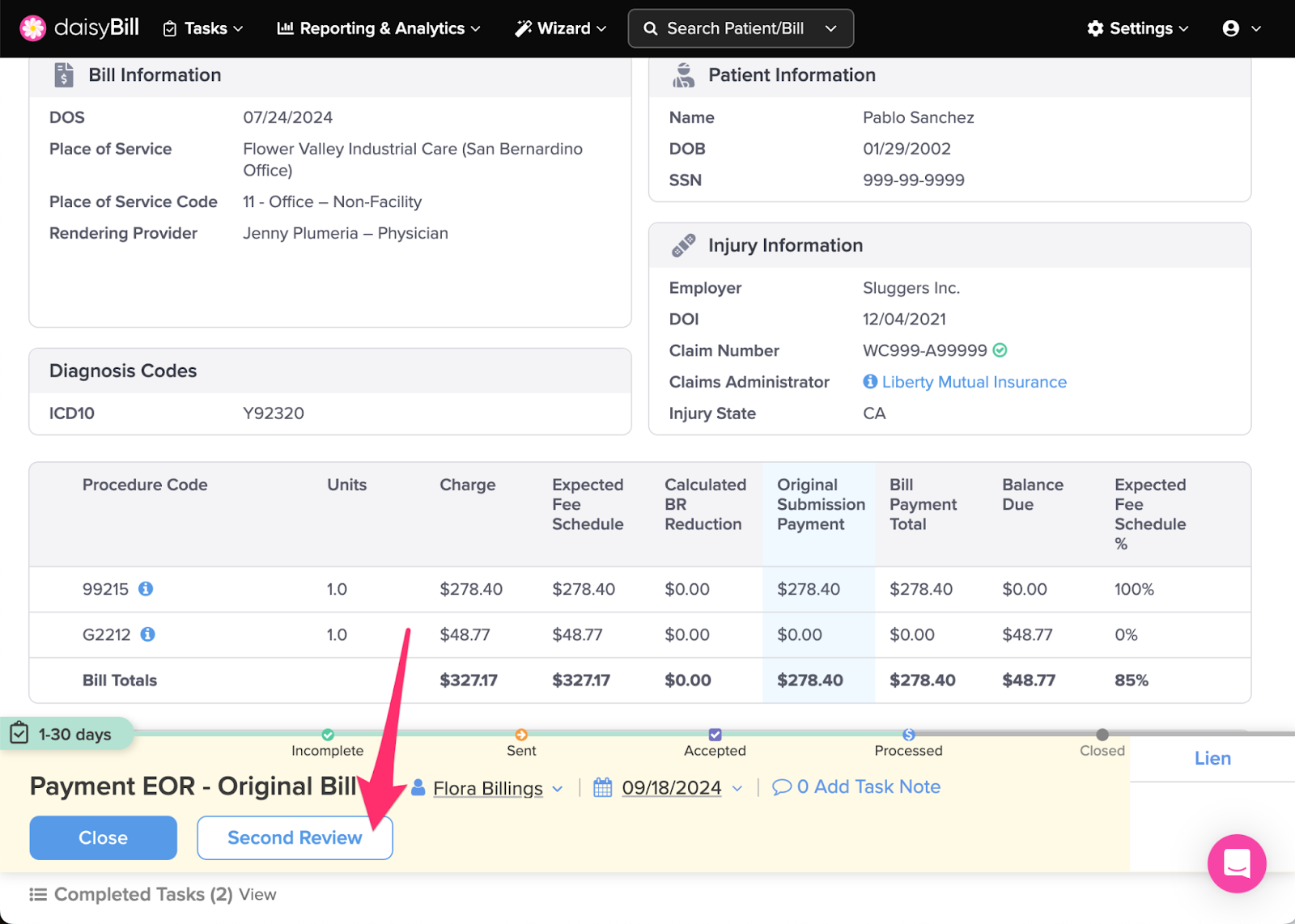

Step 2. For insufficient payments, choose an option from the ‘Action Bar’

Second Review: Changes Bill Status to Incomplete, navigates to the Second Bill Review (SBR) function. For more information, see the Help Article: Request for Second Review: Partial Payment.

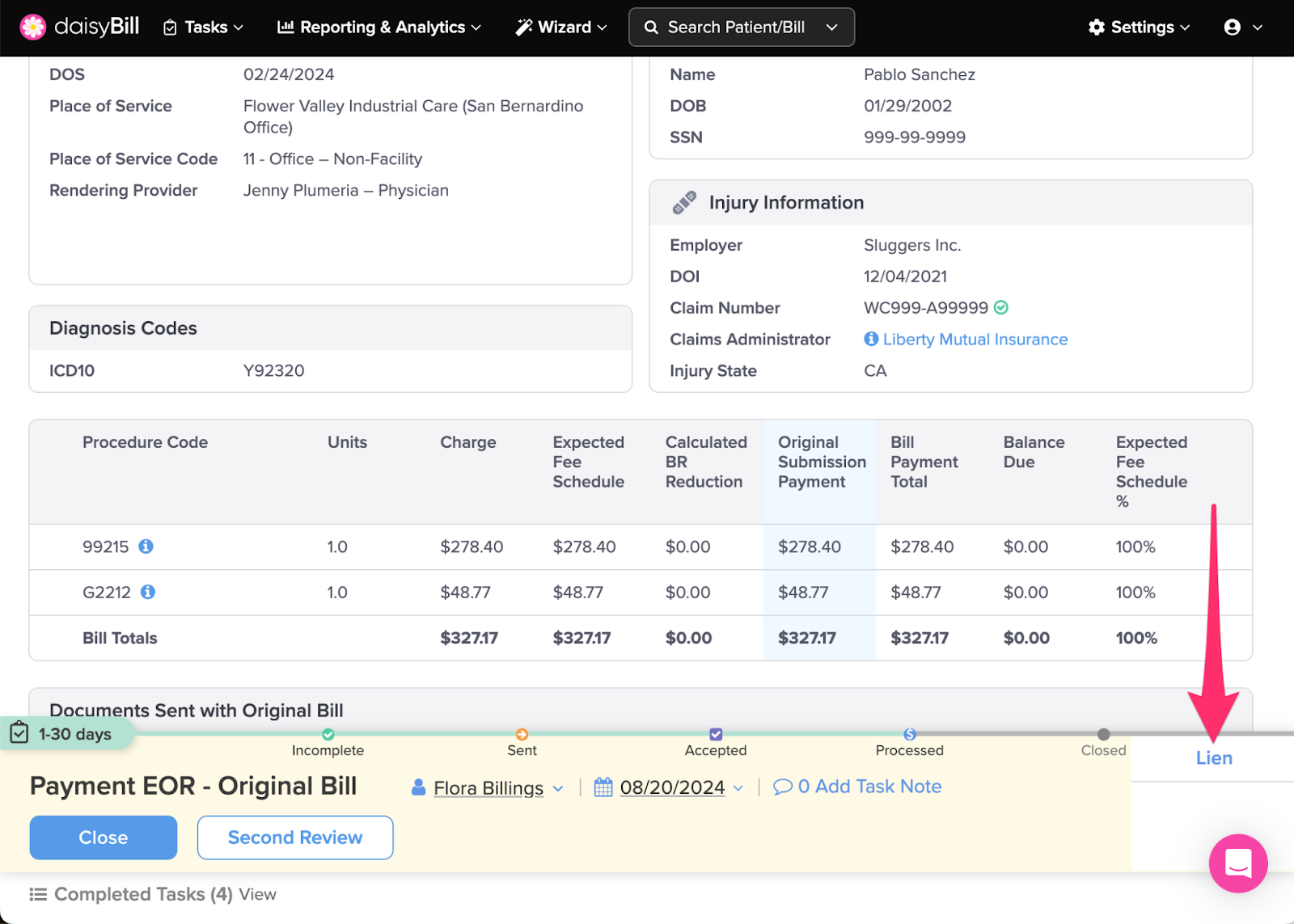

Lien: Changes Bill Status to Lien, queues the bill with all other bills for the injury marked for Lien status. (But does not file a lien. This must be done outside daisyBill.) For more information, see the Help Article: Mark Bill as Lien - Lien Filed.

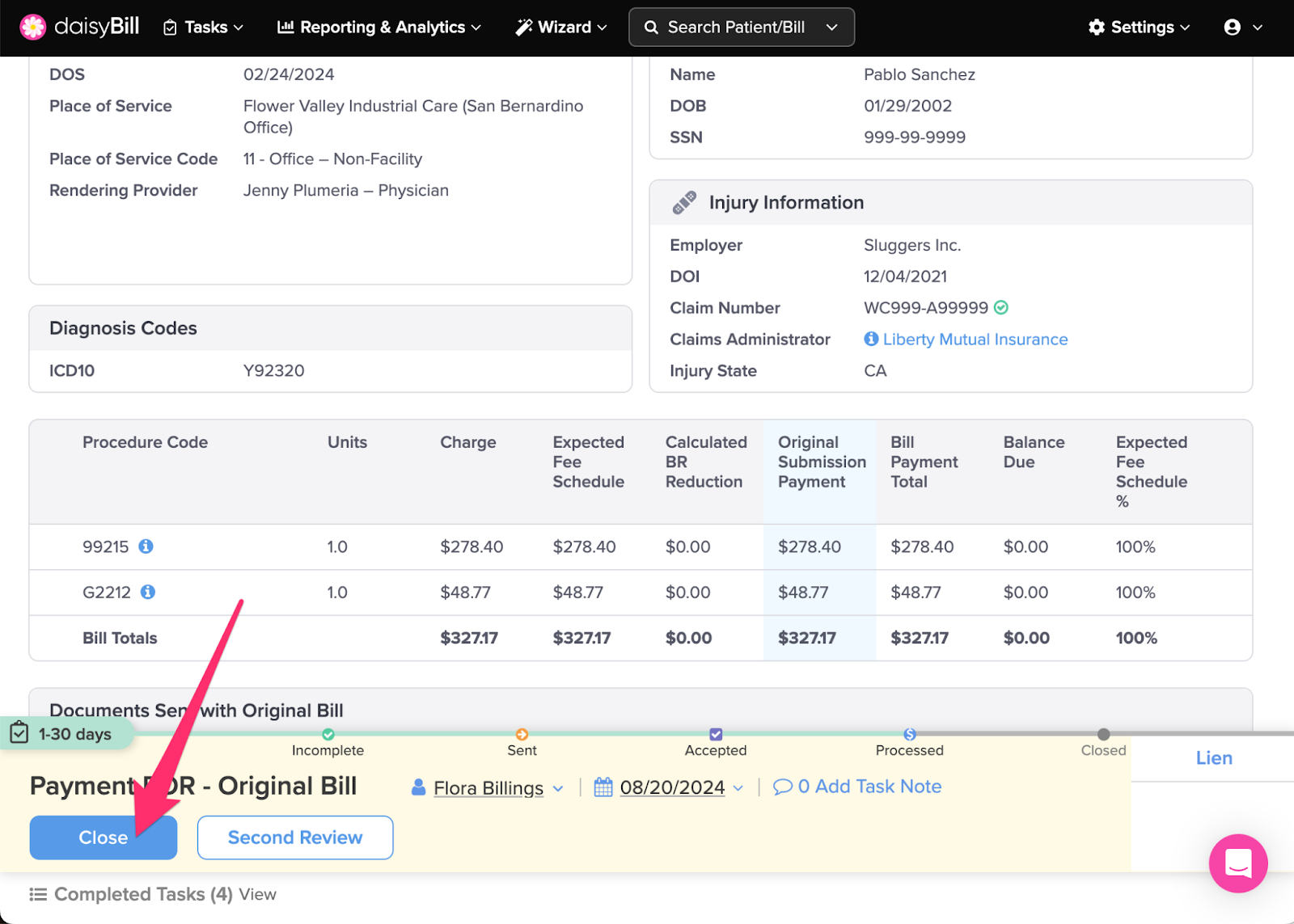

Step 3. For sufficient payments, click ‘Close’

This moves the Bill to Closed status and completes the task.

Good job!