Calculating OMFS reimbursement is a complex process that involves multiple tables, formulas and Billing Ground Rules. The OMFS Calculator considers all these factors.

Here’s an overview of how the OMFS Calculator works.

A. Components of the Maximum Reasonable Fee - Services Other than Anesthesia

The current RBRVS-based fee schedule (effective January 1, 2019) has three separate components that must be calculated together to obtain a code’s Base Maximum Fee. The Base Maximum Fee is “the maximum reasonable fee, except as otherwise provided by applicable provisions of [the] fee schedule, including but not limited to the application of ground rules and modifiers that affect reimbursement.”

For dates of service on or after January 1, 2019, the three components are:

- Relative Value Units (RVUs)

- Geographic Practice Cost Index (GPCI)

- Conversion Factor (CF)

For dates of service on or after January 1, 2014, but before January 1, 2019, the three components to the fee schedule were:

- Relative Value Units (RVUs)

- Average Statewide Geographic Adjustment Factors (GAFs)

- Conversion Factor (CF)

Both the RVU and GAF/GPCI component break down further into three subcomponents:

- Physician Work (Work)

- Practice Expense (PE)

- Malpractice Expense (MP)

All codes use only a single Conversion Factor.

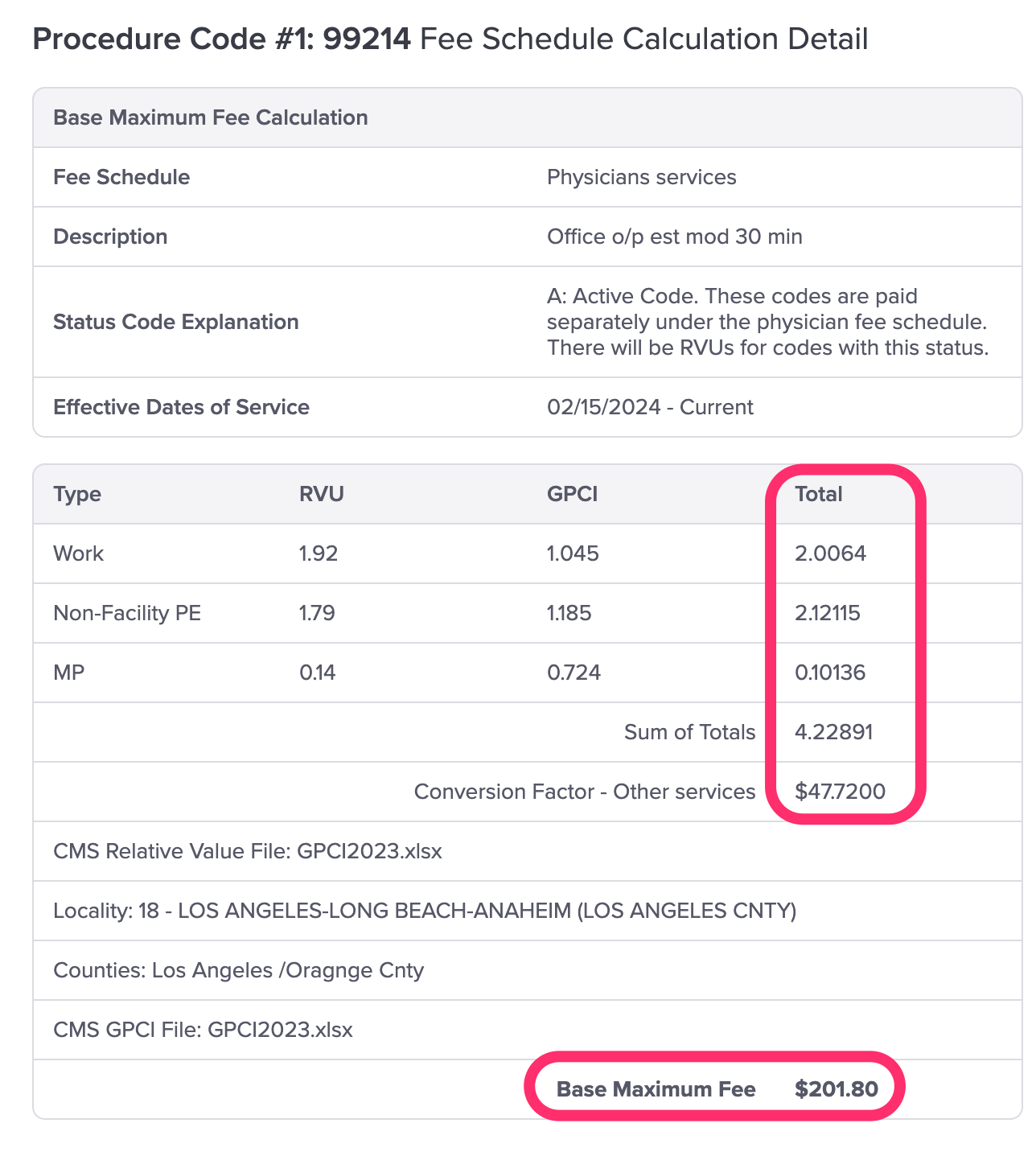

These components are located in § 9789.19 Update Table on the DWC’s website. Even a small change to a single component will have an effect on a code’s Base Maximum Fee. The OMFS Calculator displays all of these components in the OMFS Calculation Details.

daisyBill automatically updates these components as necessary to ensure calculations are accurate and up-to-date. To view these components in the OMFS Calculator, view the Detailed Explanation.

B. Calculation of the Maximum Reasonable Fee - Services Other than Anesthesia Formula

Once the components required to calculate the procedure code are obtained, CCR § 9789.12.2. Calculation of the Maximum Reasonable Fee - Services Other than Anesthesia outlines the formulas used to produce the Base Maximum Fee based on Place of Service.

For services rendered in a non-facility Place of Service Type (see the DWC’s crosswalked list of Place of Service Codes), use the formula:

For dates of service on or after January 1, 2019:

Place of Service Type: Non-facility

[(Work RVU * Work GPCI) + (Non-Facility PE RVU * PE GPCI) + (MP RVU * MP GPCI)] * Conversion Factor (CF) = Base Maximum Fee

Place of Service Type: Facility

[(Work RVU * Work GPCI) + (Facility PE RVU * PE GPCI) + (MP RVU * MP GPCI)] * Conversion Factor (CF) = Base Maximum Fee

For dates of service on or after January 1, 2014, but before January 1, 2019:

Place of Service Type: Non-facility

[(Work RVU * Statewide Work GAF) + (Non-Facility PE RVU * Statewide PE GAF) + (MP RVU * Statewide MP GAF)] * Conversion Factor (CF) = Base Maximum Fee

Place of Service Type: Facility

[(Work RVU * Statewide Work GAF) + (Facility PE RVU * Statewide PE GAF) + (MP RVU * Statewide MP GAF)] * Conversion Factor = Base Maximum Fee

The OMFS Calculator displays all of these calculations in the OMFS Calculation Details.

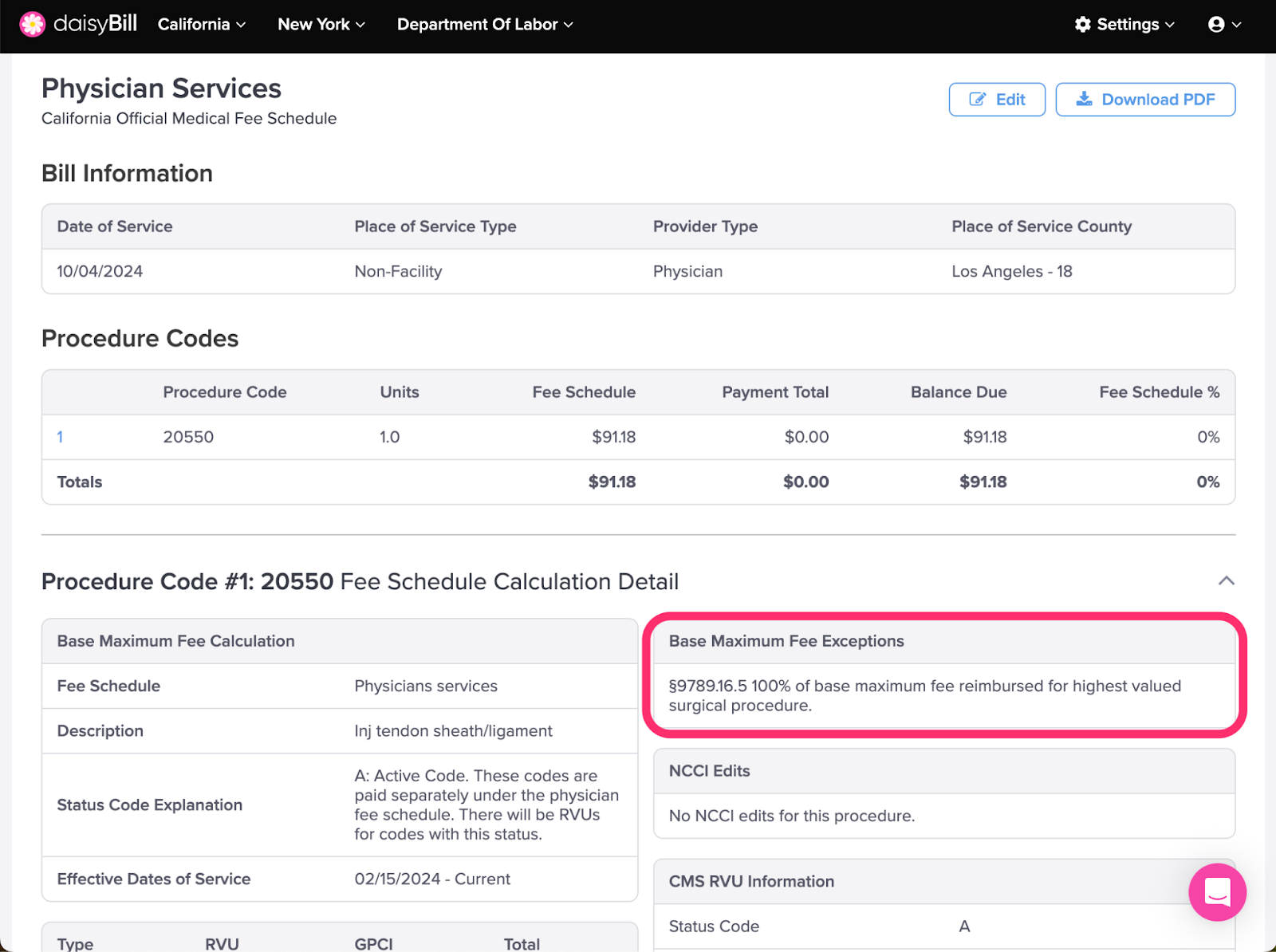

C. Application of Fee Affecting Regulations

Once the Base Maximum Fee is calculated Article 5.3 of the California Code of Regulations outlines additional fee affecting regulations that may affect the OMFS reimbursement.

There are 40 fee affecting regulations. The OMFS Calculator displays this information in the Base Maximum Fee Exceptions section of the Detailed Explanation and cites the appropriate regulation.

We hope that helps!