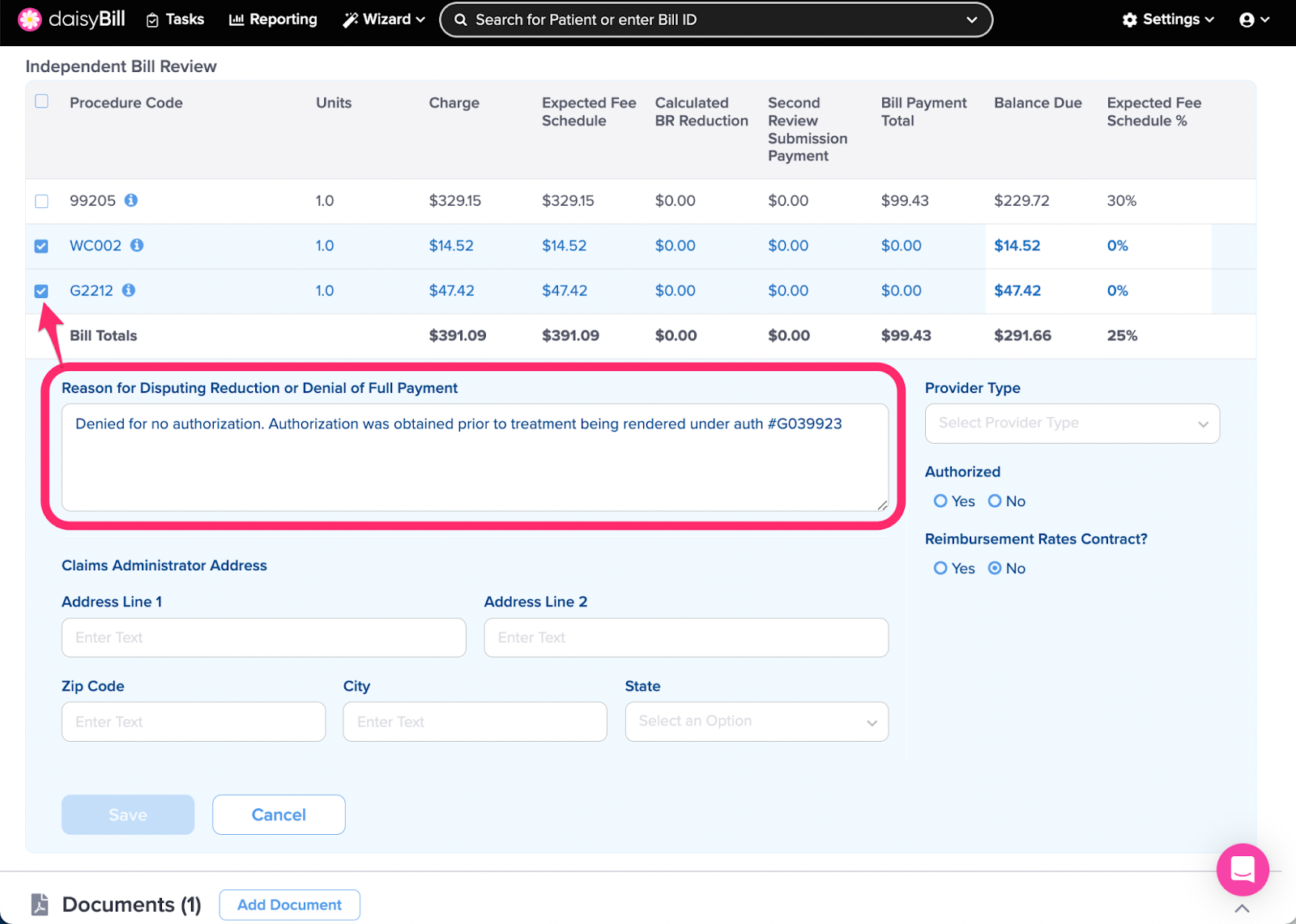

daisyBill makes it easy to request Second Reviews / Appeals for incorrect reimbursement amounts or denials. But explaining Second Reviews / Appeals takes time. The sample language below will help.

Sample Second Review / Appeal Language

To quickly populate a DWC Form SBR-1 with substantive reasons, store these Custom Phrases to your Second Review / Appeal Reasons.

99070

99070: Incorrect Payment

This medication was incorrectly reimbursed per the fee schedule for this date of service. Per OMFS section 9789.40(a) the max reasonable fee for pharmaceuticals and pharmacy services is 100% of the reimbursement prescribed in the relevant Medi-Cal payment system, including the Medi-Cal Professional fee of $7.25 for dispensing.

99070: $0 Payment

Per § 9789.13.3 reimbursement for Physician Dispensed Drugs is calculated using the Pharmaceutical Fee Schedule §9789.40. The Pharmaceutical Fee Schedule does not utilize CMS Status Codes to determine reimbursement amounts, therefore, CPT code 99070 is not "bundled" into other paid services. The NDC number billed for this date of service is valid and payable. Per OMFS section 9789.40(a), the max reasonable fee for pharmaceuticals and pharmacy services is 100% of the reimbursement prescribed in the relevant Medi-Cal payment system, including the Medi-Cal Professional fee of $7.25 for dispensing.

CA Specific Codes

WC002: Primary Treating Physician

Per Article 5.3 of the OMFS: The following types of treatment reports are separately reimbursable. (1) Primary Treating Physician's Progress Report (Form PR-2), issued in accordance with section 9785(f), using DWC form PR-2, it’s narrative equivalent, or letter format where allowed by section 9785.

DME

DME: $0 Payment

Pursuant to Labor Code 5307.1 and CCR section 9789.60 workers’ compensation DMEPOS maximum is 120% of the Medicare CMS rate for California.

DME: Invoice Required

If a distributed supply is on the CMS list of DMEPOS, an invoice is NOT required for payment. Invoices are only required for distributed items that are NOT included on the DMEPOS fee schedule. Because this code is included in the DMEPOS schedule, NO INVOICE IS REQUIRED. The California Official Medical Fee Schedule (OMFS) uses the CMS’ DMEPOS to determine payment for durable medical equipment, supplies and materials, orthotics, prosthetics, and miscellaneous supplies and services. Please pay immediately as penalties and interest are accruing.

DME: MUE

A medically necessary piece of DME may not be denied based on the Practitioner Services MUE. DME is NOT part of the physicians fee schedule and thus MUE edits do not apply. Please reprocess this line item immediately.

Treatment

Diagnostic (including x-ray): Global

Per Section 9789.16.1(a)(3) of the regulations “Services Not Included in the Global Surgical Package:...[include]...(E) Diagnostic tests and procedures, including diagnostic radiological procedures”. This [describe diagnostic code] is due and payable separately.

Splints and Casting: Global

Per Section 9789.16.1(a)(3) of the regulations “Services Not Included in the Global Surgical Package…[include] (l) Splints and Casting supplies.” This code is due and payable separately within the global period.

Please see attached Explanation of Fee Schedule (EOFS) with OMFS Calculation Detail.

Evaluation and Management

992XX: Global

Per section 9789.16.4(a) Provider may bill one or more E&M codes for medically necessary services that exceed number of visits listed for the global surgical code in the Medicare “Physician Time File.” Services were medically necessary please immediately reprocess.

Incorrect NCCI Edit Denials

For processed bills, if daisyBill displays an Expected amount greater than $0 and a claims administrator denies a procedure code using NCCI edits as the rationale for the denial, consider submitting a Request for Second Review to appeal the incorrect reimbursement.

- CCI Edits - Per § 9789.12.13 Correct Coding Initiative, reimbursement is due for this procedure code as CCI edits were not violated per the Physician CCI Edits: National Correct Coding Initiative Edits (“NCCI”) adopted by the CMS.

- MUE - Per § 9789.12.13 Correct Coding Initiative, reimbursement is due for this procedure code as MUE were not violated per Practitioner Services MUE Table: Medically Unlikely Edits are published by CMS.

Incorrect MPPR Denial

The Medicare Multiple Procedure Payment Reduction (MPPR) was incorrectly applied to this bill. Full payment should be made for CPT 97140 as it has the highest Practice Expense (PE). Per §9789.15.4 "Full payment is made for the unit or procedure with the highest PE payment. Full payment is made for the work and malpractice components and 50 percent payment is made for the PE for subsequent units and procedures, furnished to the same patient on the same day.”

Misc. Incorrect Denials

Missing Documentation

EOR incorrectly states supporting documents were not received for this electronically submitted bill. The electronic transmission of this bill confirmed to the DWC’s Electronic Companion Guide. As documented in the attached Bill History, the claim administrator returned an accepted acknowledgement verifying receipt of Original Bill and Supporting Documents.

PPO Incorrectly Applied

This bill payment was incorrectly discounted [DISCOUNT AMOUNT] with the EOR citing a “PPO Discount”. Per LAB 4609 § (c)(2) the provider is requesting the entity demonstrate the entitlement to a reduced rate within 30 days. Failure to timely demonstrate that entity is entitled to the reduced contracted rate shall both:

1. Render entity responsible for the difference between the OMFS rate(s) and the reduced contract rate(s) used in paying the bill, which amount(s) shall be due and payable within ten (10) days of receipt of written notice, and

2. Bar entity from taking any future discounts without express written consent from provider.

With this language in your pocket, requesting Second Reviews / Appeals is a breeze!