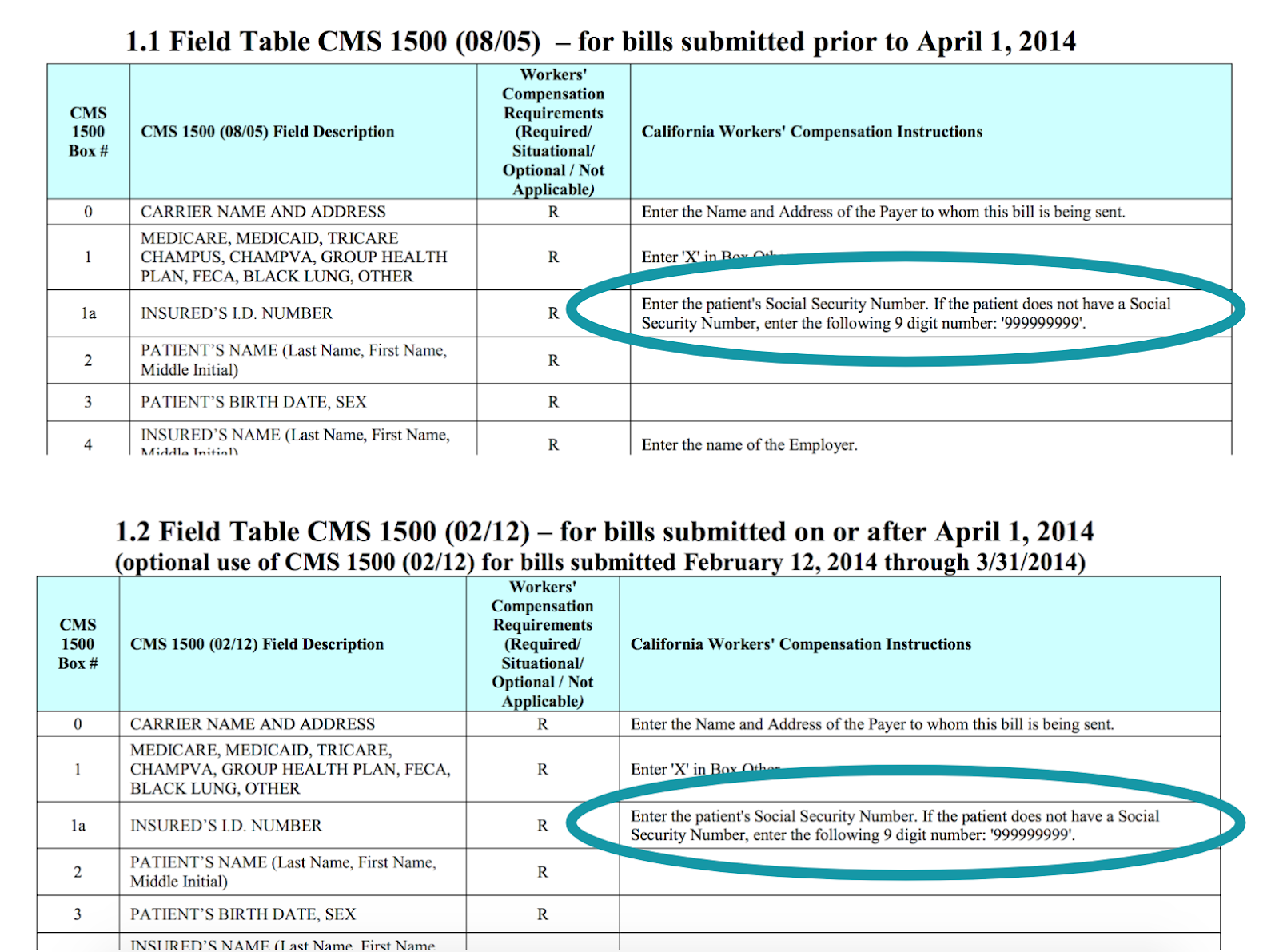

Field 1A of the CMS 1500 form requires a patient’s social security number. In most cases, you must attain and use the correct SSN.

Social Security Numbers Required

Field 1a of the CMS-1500 is a required field and must be completed with the injured worker’s social security number.

When an injured worker is not assigned a social security number, enter “999999999” in Field 1a of CMS 1500. If an injured worker is assigned a social security number but does not want to reveal the number for security or other reasons, do not enter “999999999” in Field 1a.

Instead, explain to the injured worker that the social security number is a requirement of the State of California. The California Division of Workers’ Comp (DWC) offers no choice but to use the patient’s SSN.

If necessary, explain to the patient that treatment cannot proceed without a patient SSN, because a missing SSN means that the provider cannot submit the bill to receive payment for the treatment.

If you don’t have one already, daisyBill has prepared a Sample Intake Form which is free to download.

Additional Information

Division of Workers’ Compensation Medical Billing and Payment Guide

daisyBill Resources

Webinar: California Workers’ Compensation: Master the Original Bill

daisyBill Mailing List

Stay up-to-date by subscribing to daisyBill’s email list.

SIGN UP FOR EMAILS