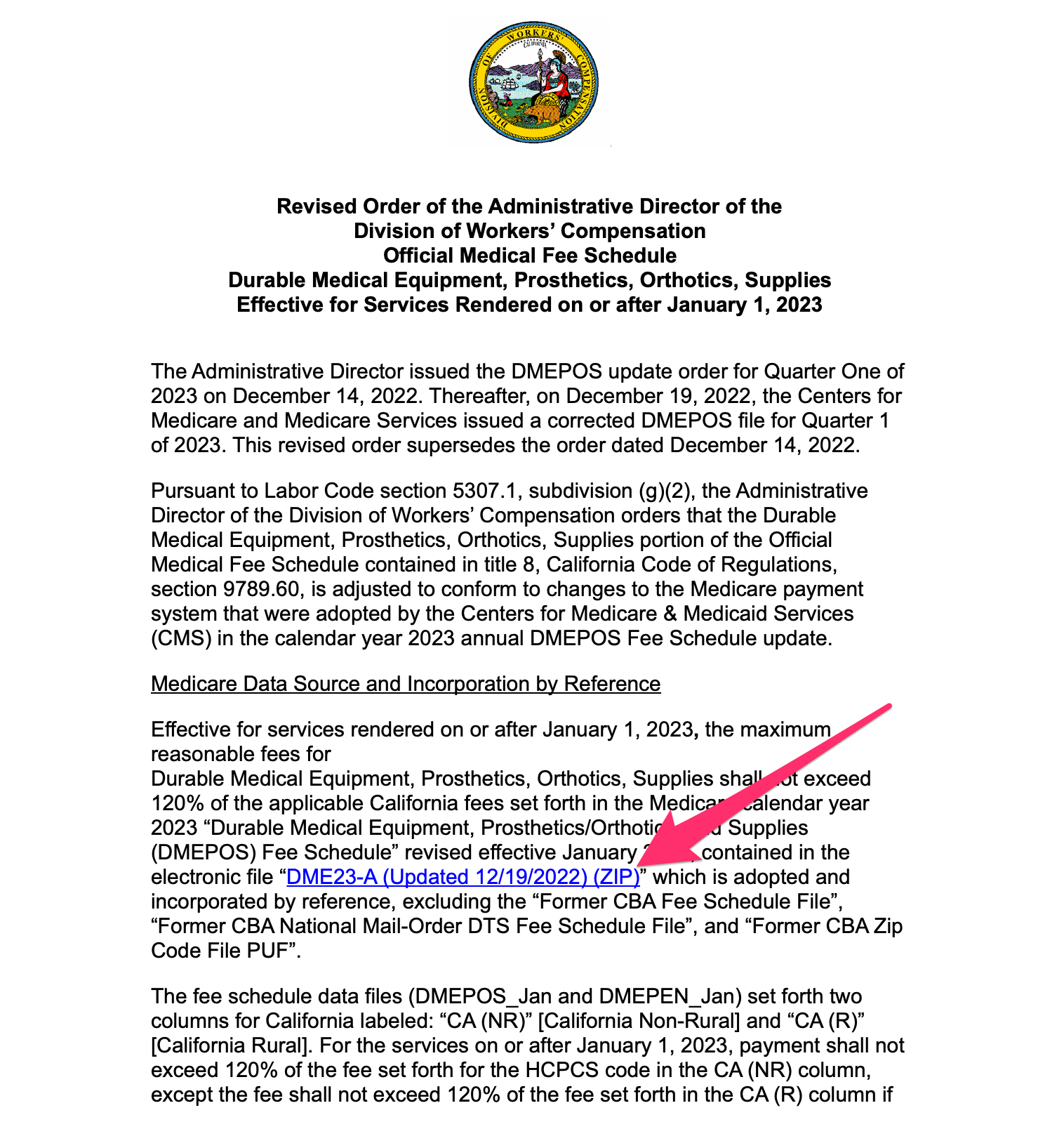

For California, the DMEPOS Fee Schedule is a separate fee schedule from the Physician and Non-physician Services Fee Schedule. For workers' comp in California, DMEPOS is reimbursed at 120% of the currently adopted Medicare DMEPOS rate.

To calculate DMEPOS fee schedule, follow the steps below:

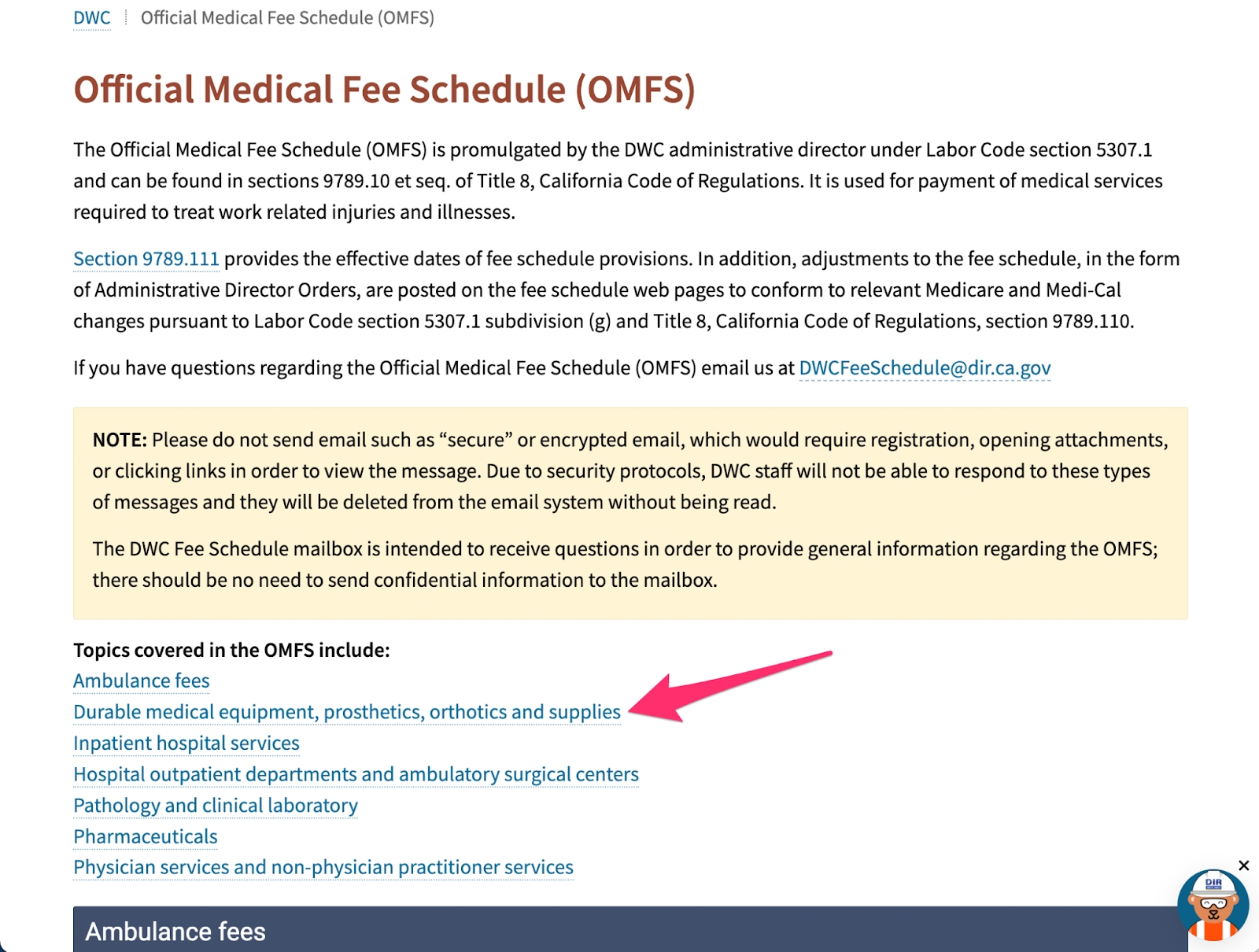

Step 1. Open the DWC's OMFS Page → Click ‘Durable medical equipment, prosthetics, orthotics and supplies’ Link

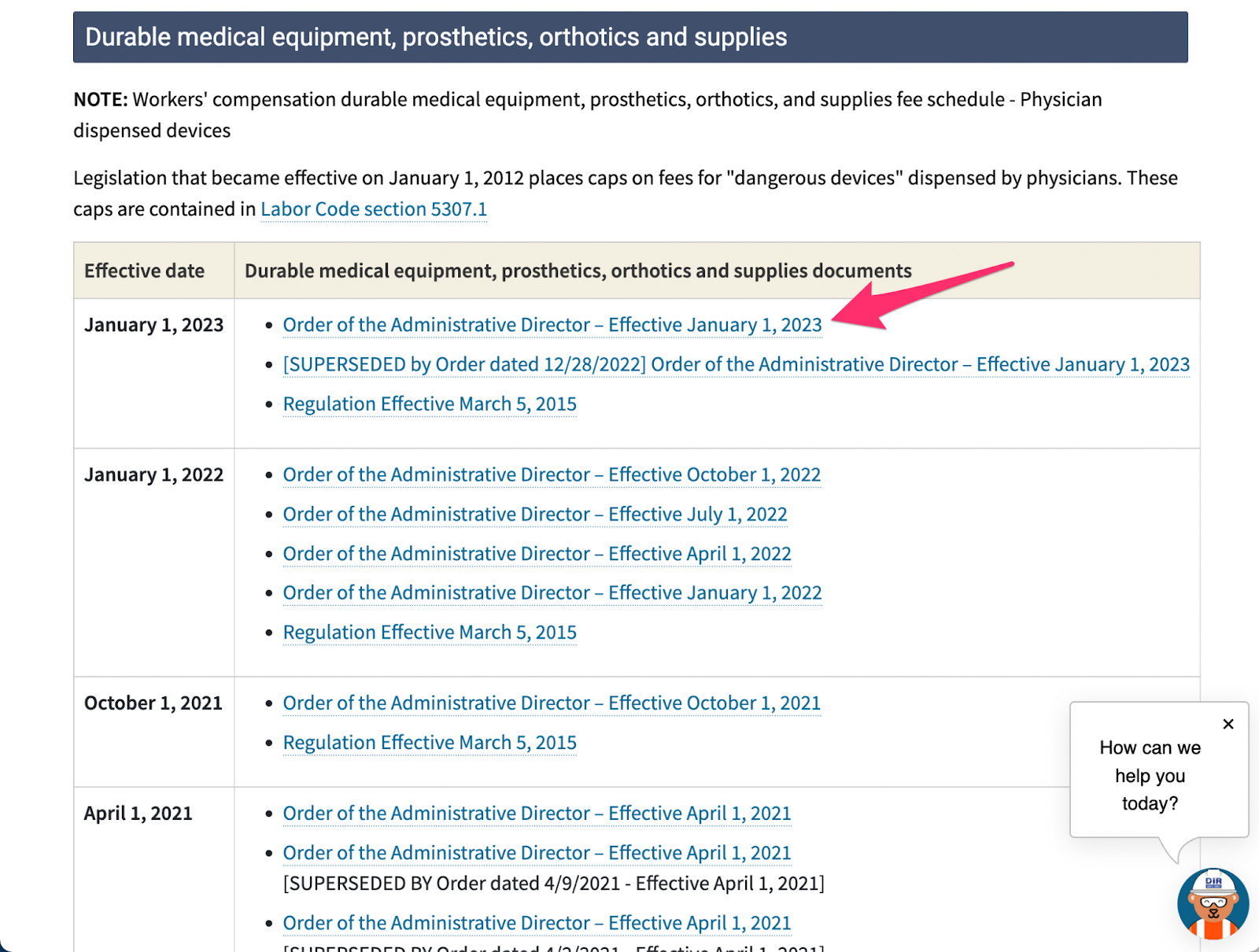

Step 2. To Download the Latest Fee Schedule Documents → Click on the Order of the Administrative Director

Step 3. From Download → Click the ‘DME23-A’ Link

This can also be downloaded from the CMS website.

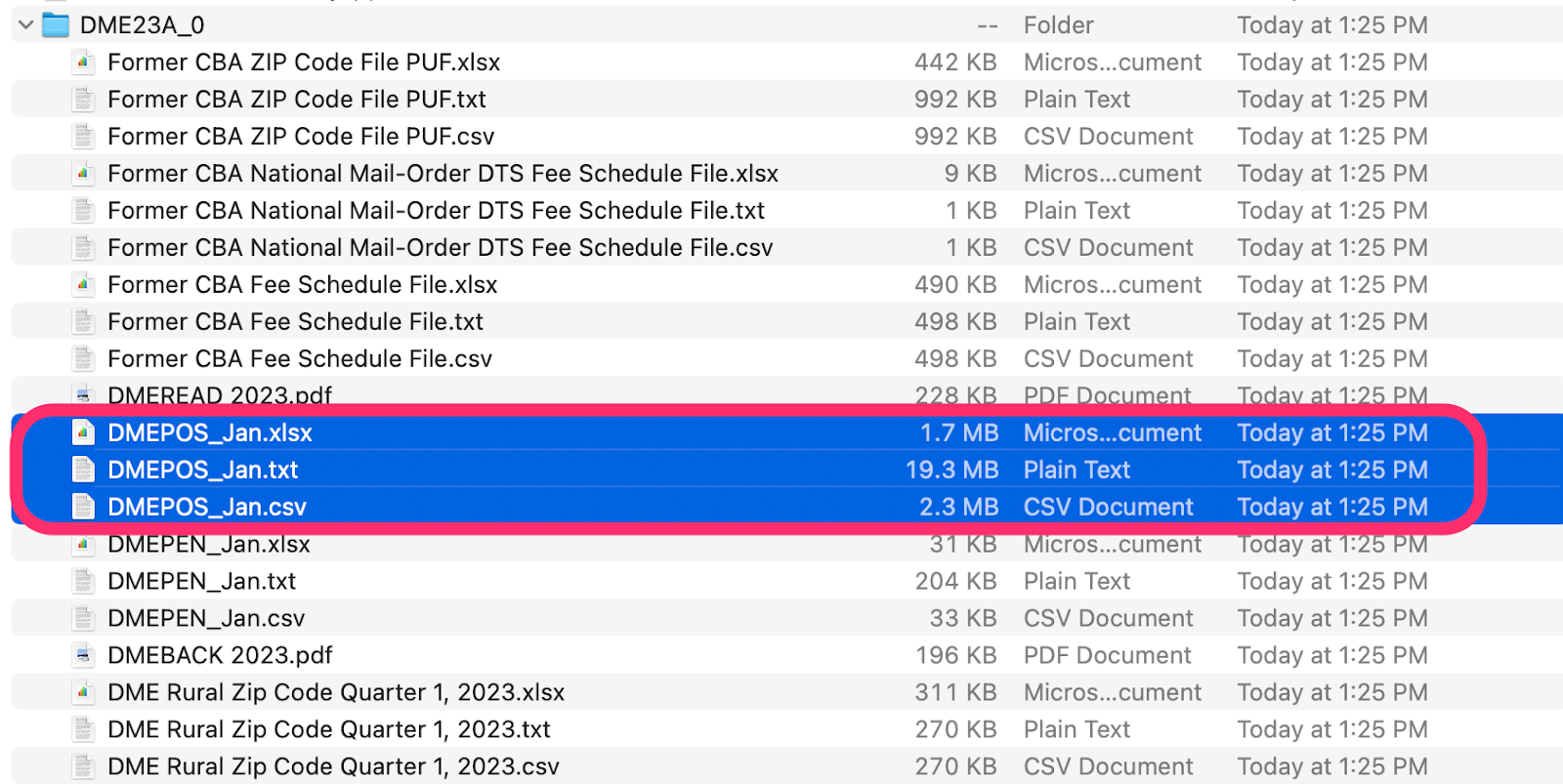

Step 4. Open ZIP File → Open ‘DMEPOS_JAN’ File in CSV, TXT, or XLSX Format

Make sure you are using the most current fee schedule, as the DWC updates the DMEPOS fee schedule several times a year. Also, the workers' comp DMEPOS fee schedule may not be updated on the same schedule as the Medicare one, so don't rely on only Medicare sources.

IMPORTANT: Don’t make the mistake of thinking the DME amount listed in Medicare’s file is the reimbursement amount. You MUST make the 120% calculation yourself.

California Labor Codes

California Code of Regulations (CCR)

§ 9789.60 Durable Medical Equipment, Prosthetics, Orthotics, Supplies

Division of Workers’ Compensation Websites

DWC Official Medical Fee Schedule

daisyBill Solution

For the easiest way to keep up with California fee schedules and rule changes, sign up for the daisyBill Work Comp Wizard. Click below for a FREE three day trial and start easy calculations today.