Summary

This article breaks down the process for calculating the Base Maximum Fee with the Physician Services Fee Schedule for workers’ compensation in California, excluding anesthesia. From determining the place of service to applying the necessary values and ground rules, we explain how it’s done.

To calculate the Base Maximum Fee, the current Resource-Based Relative Value Scale (RBRVS) fee schedule (effective January 1, 2014, through December 31, 2018) requires the calculation of three separate components:

- Relative Value Units (RVUs)

- Average Statewide Geographic Adjustment Factors (GAFs)

- Conversion Factor (CF)

Both the RVU and GAF components break down further into three subcomponents:

- Physician Work (Work)

- Practice Expense (PE)

- Malpractice Expense (MP)

Calculating the Base Maximum Fee

To calculate the Base Maximum Fee for a procedure code, follow the steps below.

Step 1. Determine the Place of Service

First, determine if the place of service is Facility or Non-Facility. The place of service is defined by the setting in which the patient received the face-to-face service.

- Regulation 9789.12.2(d) provides a table that assigns each type of Place of Service an “F” for Facility or “NF” for Non-facility.

Step 2. Determine RVU Values

Step 2. Determine RVU Values

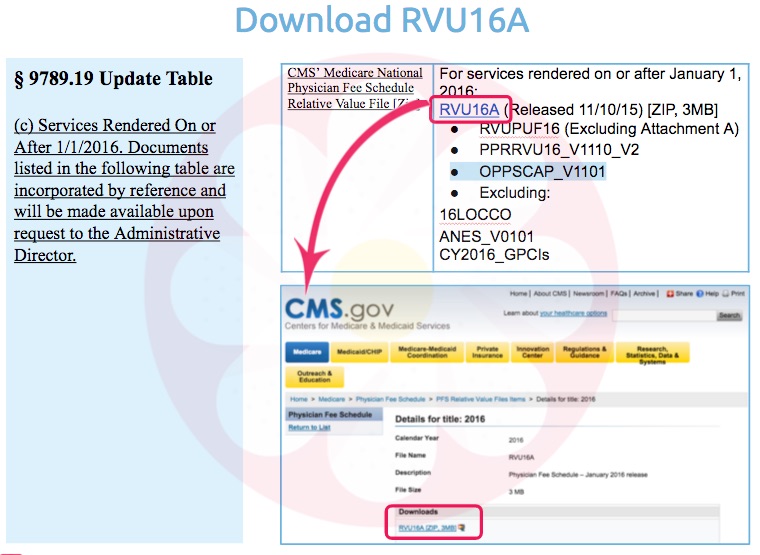

Regulation 9789.19, which is the Update Table, Subsection C, contains a link to Medicare’s new RVUs. To download the new RVUs for procedure codes, click the RVU16A link to the Medicare website. The RVU file provides the three RVU values for the procedure code. The three RVU values are:

- Physician Work (Work)

- Practice Expense (PE)

- Malpractice Expense (MP)

Step 3. Determine GAF Values

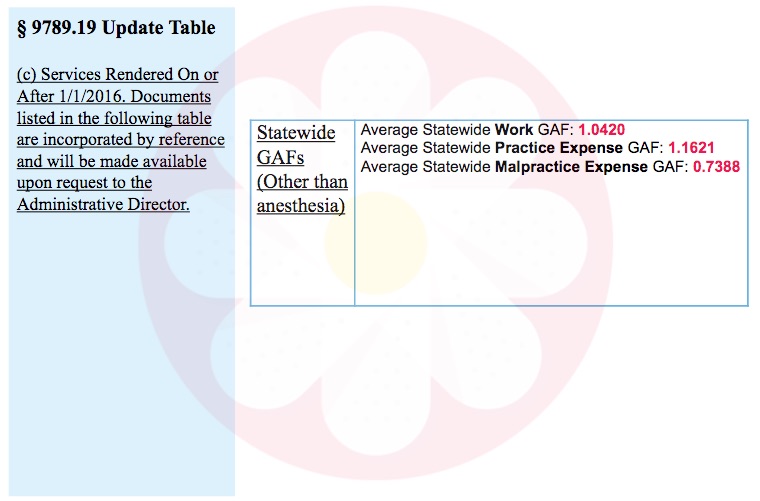

After determining the three RVUs, next, determine the three Statewide Geographic Adjustment Factors (GAFs).

Step 4. Identify the Conversion Factor

Conversion Factors are regularly updated by the DWC. The most recent CFs can be found in the Physician Services fee schedule; Regulation 9789.19, which is the Update Table, Subsection C. Select the conversion factor that matches the type of HCPCS / Procedure Code for the appropriate date of service.

For dates of service from January 1, 2014 but before March 1st, 2015 the four conversion factors were as follows:

- Anesthesia Conversion Factor: $33.8190

- Surgery Conversion Factor: $55.2913

- Radiology Conversion Factor: $53.1039

- Other Services Conversion Factor: $38.3542

For dates of service from March 1st, 2015 through December 31st, 2015 the four conversion factors were as follows:

- Anesthesia Conversion Factor: $31.5290

- Surgery Conversion Factor: $51.6570

- Radiology Conversion Factor: $50.1900

- Other Services Conversion Factor: $40.2970

For dates of service from January 1st, 2016 through March 31st, 2016 the four conversion factors were as follows:

- Anesthesia Conversion Factor: $29.3852

- Surgery Conversion Factor: $48.2013

- Radiology Conversion Factor: $47.4598

- Other Services Conversion Factor: $42.4599

For dates of service from April 1st, 2016 through December 31st, 2016 the four conversion factors were as follows:

- Anesthesia Conversion Factor: $28.8003

- Surgery Conversion Factor: $48.1743

- Radiology Conversion Factor: $47.4332

- Other Services Conversion Factor: $42.4361

In 2017, Senate Bill 863 required this system to be simplified. Effective March 1st of that year, the conversion factors for surgery and radiology will roll into the CF for all other services, leaving a total of just two CFs—one for anesthesia, and one for all other services. For more information, visit our blog. For dates of service from March 1st, 2017 through December 31st, 2017 the conversion factors were as follows:

- Anesthesia Conversion Factor: $26.8011

- Other Services Conversion Factor: $44.6572

For dates of service from January 1st, 2018 through December 31st, 2018 the conversion factors were as follows:

- Anesthesia Conversion Factor: $27.2415

- Other Services Conversion Factor: $45.2371

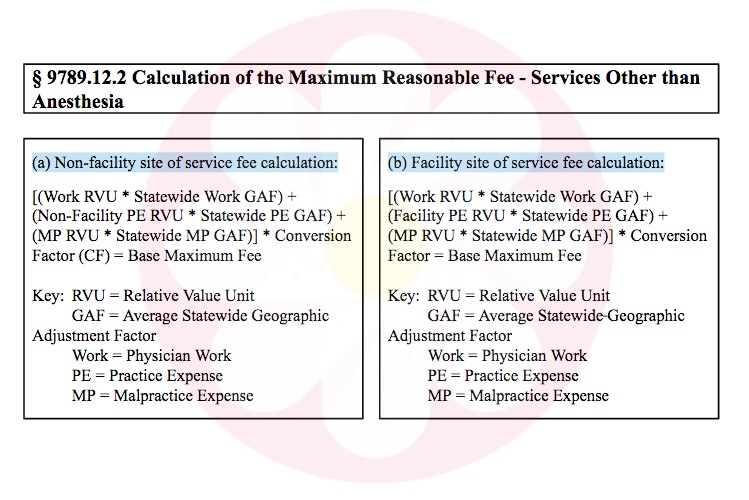

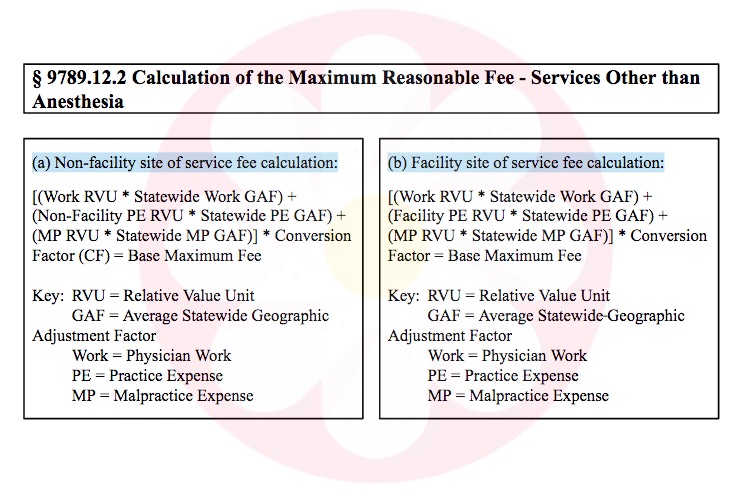

Step 5. Apply the Formula

Select the correct formula (Non-Facility or Facility) and calculate the base maximum fee using the RVUs, GAFs, and Conversion Factor. To calculate the Base Maximum fee:

- First, Multiply the RVU Values by the GAF Values.

- Next add together the three Totals from the multiplied RVUs and GAFs to get the Sum of Values.

- Finally, multiply the Sum of Values by the appropriate Conversion Factor.

Apply relevant ground rules, if any, to the Base Maximum Fee to determine the payable fee.

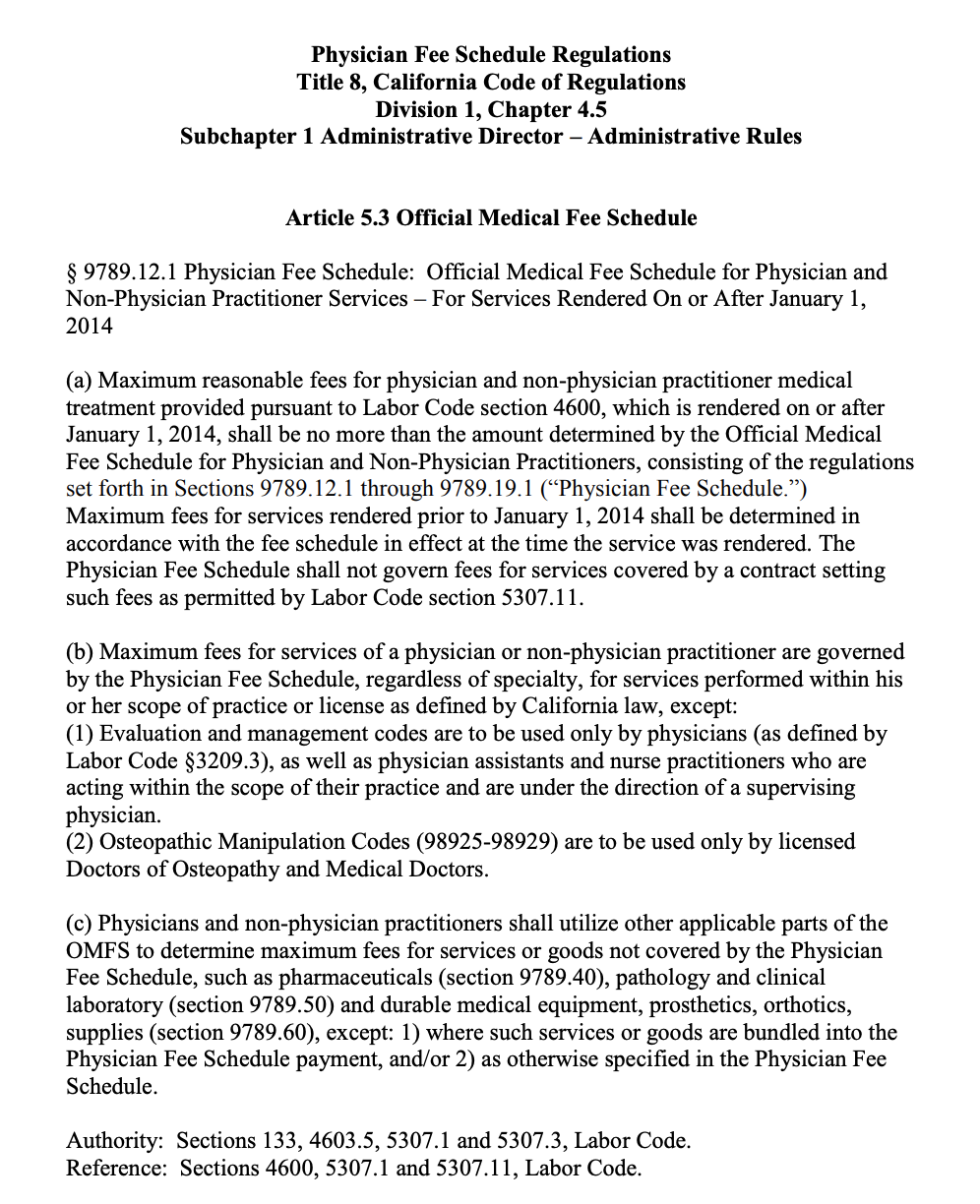

Ground rules are located in the Physician Fee Schedule Regulations.

The Physician Fee Schedule is NOT 120% of Medicare’s reimbursements

The Physician fee schedule is NOT 120% of Medicare’s reimbursements. One of the most common misunderstandings about the RBRVU-based Physician Fee Schedule is the belief that the reimbursement is a simple calculation of 120% of the Medicare reimbursement rates. Other than sharing RVU values, there are no other similarities between the Medicare and the Physician Fee Schedule reimbursements.

California Code of Regulations (CCR)

§ 9789.12.2 Calculation of the Maximum Reasonable Fee - Services Other than Anesthesia

Division of Workers’ Compensation Websites

daisyBill Solution

For the easiest way to keep up with California fee schedules and rule changes, sign up for the daisyBill Work Comp Wizard. Click below for a FREE three day trial and start easy calculations today.