This article explains how to access the Relative Value Units (RVUs) used in the Base Maximum Fee calculation for the Physician Services Fee Schedule.

Explanation

The Base Maximum Fee calculation for the RBRVS-based Physician Services fee schedule (effective for dates of service January 1, 2014 – December 31, 2018) is comprised of three separate components:

- Relative Value Units (RVUs)

- Average Statewide Geographic Adjustment Factors (GAFs)

- Conversion Factor (CF)

Both the RVU and GAF components break down further into three subcomponents:

- Physician Work (Work)

- Practice Expense (PE)

- Malpractice Expense (MP)

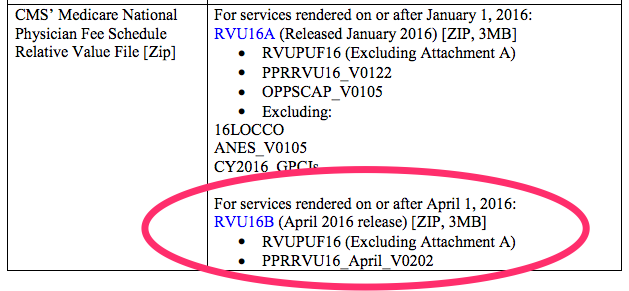

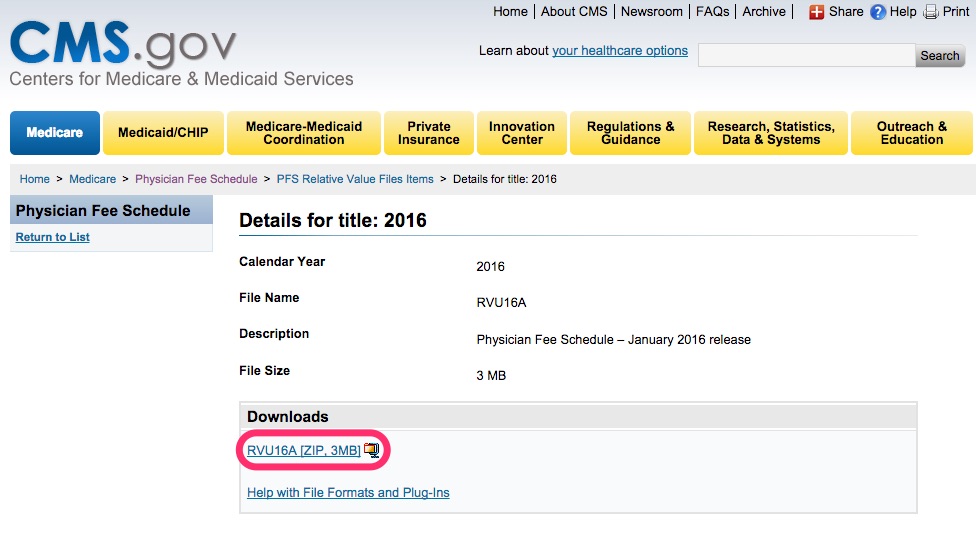

Regulation 9789.19, which is the Update Table, contains links to Medicare’s RVUs.

Clicking the link for the most recent RVU file navigates to the Medicare website where you can download the RVUs for procedure codes.

Healthcare Common Procedure Coding System (HCPCS)

Medicare assigns each HCPCS / Procedure code four RVU values:

- Work RVUs – Account for the time, technical skill and effort, mental effort and judgment, and stress to provide a service.

- Non-Facility Practice Expense RVUs – For services provided in a physician’s office. Includes clinical staff time and the equipment and supplies typically used during a visit or procedure, as well as a share of the indirect expenses of a physician practice such as administrative staff, building space, and office supplies.

- Facility Practice Expense RVUs – For services provided in a facility, physicians are paid a “facility based” practice expense RVU which excludes the practice expenses provided by the facility.

- Malpractice RVUs – These are generally the smallest component of the RVU values and represent payment for the professional liability expenses.

HCPCS: Healthcare Common Procedure Coding System

- Level I consists of the American Medical Association's Current Procedural Terminology (CPT) and is numeric.

- Level II codes are alphanumeric and primarily include non-physician services such as ambulance services and durable medical equipment. Level II codes represent items and supplies and non-physician services, not covered by CPT codes (Level I).

- Level III codes, also called local codes, developed by state Medicaid agencies, Medicare contractors, and private insurers for use in specific programs and jurisdictions.

Additional Information

daisyBill Resources

Webinar: Workers’ Compensation Fee Schedules

daisyBill Solution

Thousands of workers’ comp professionals use daisyBill’s Revenue Cycle Management software to compliantly process electronic bills. To learn more, schedule a no-pressure demo with one of our billing experts.