This article explains how to access the Relative Value Units (RVUs) used in the Base Maximum Fee calculation for the Physician Services Fee Schedule.

Explanation

The Base Maximum Fee calculation for the RBRVS-based Physician Services fee schedule (effective for dates of service on or after January 1, 2019) is comprised of three separate components:

- Relative Value Units (RVUs)

- Geographic Practice Cost Indices (GPCIs)

- Conversion Factor (CF)

Both the RVU and GPCI components break down further into three subcomponents:

- Physician Work (Work)

- Practice Expense (PE)

- Malpractice Expense (MP)

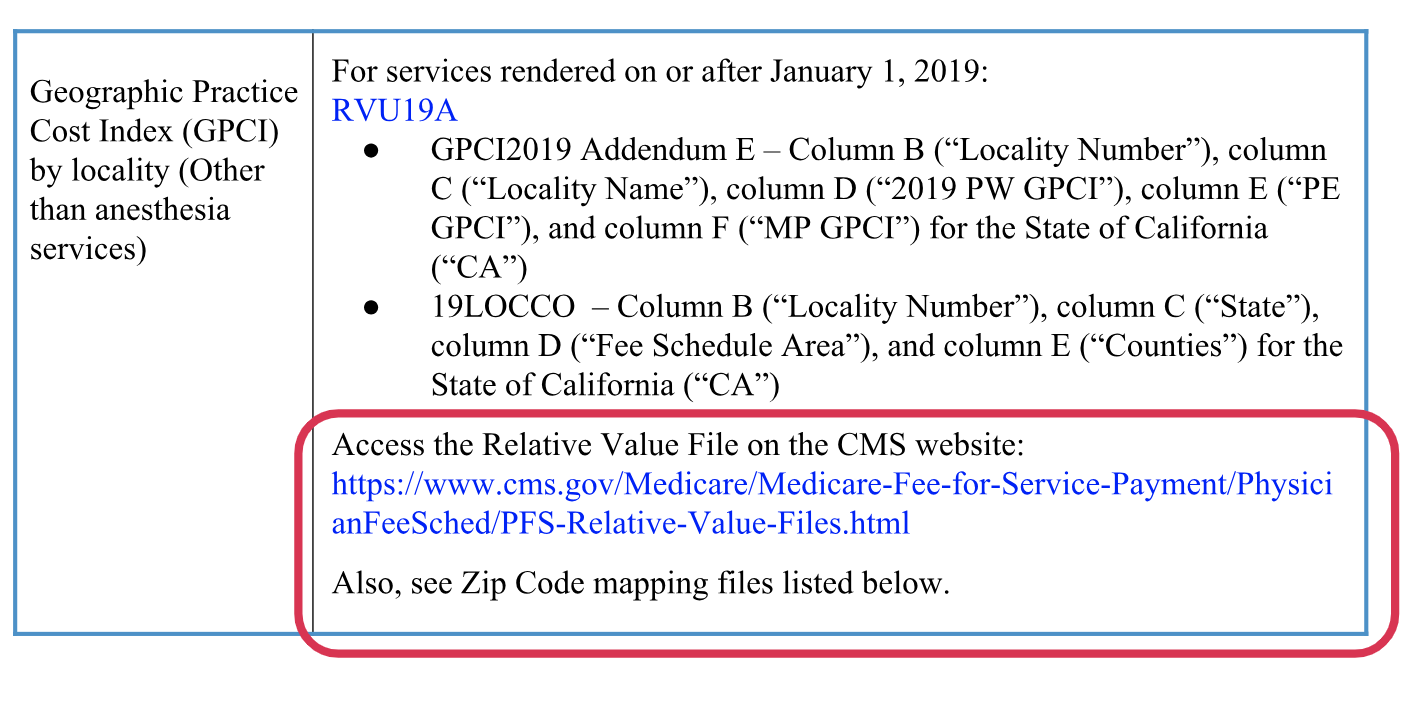

Regulation 9789.19 in the Official Medical Fee Schedule, which is the Update Table, contains links to Medicare’s RVUs.

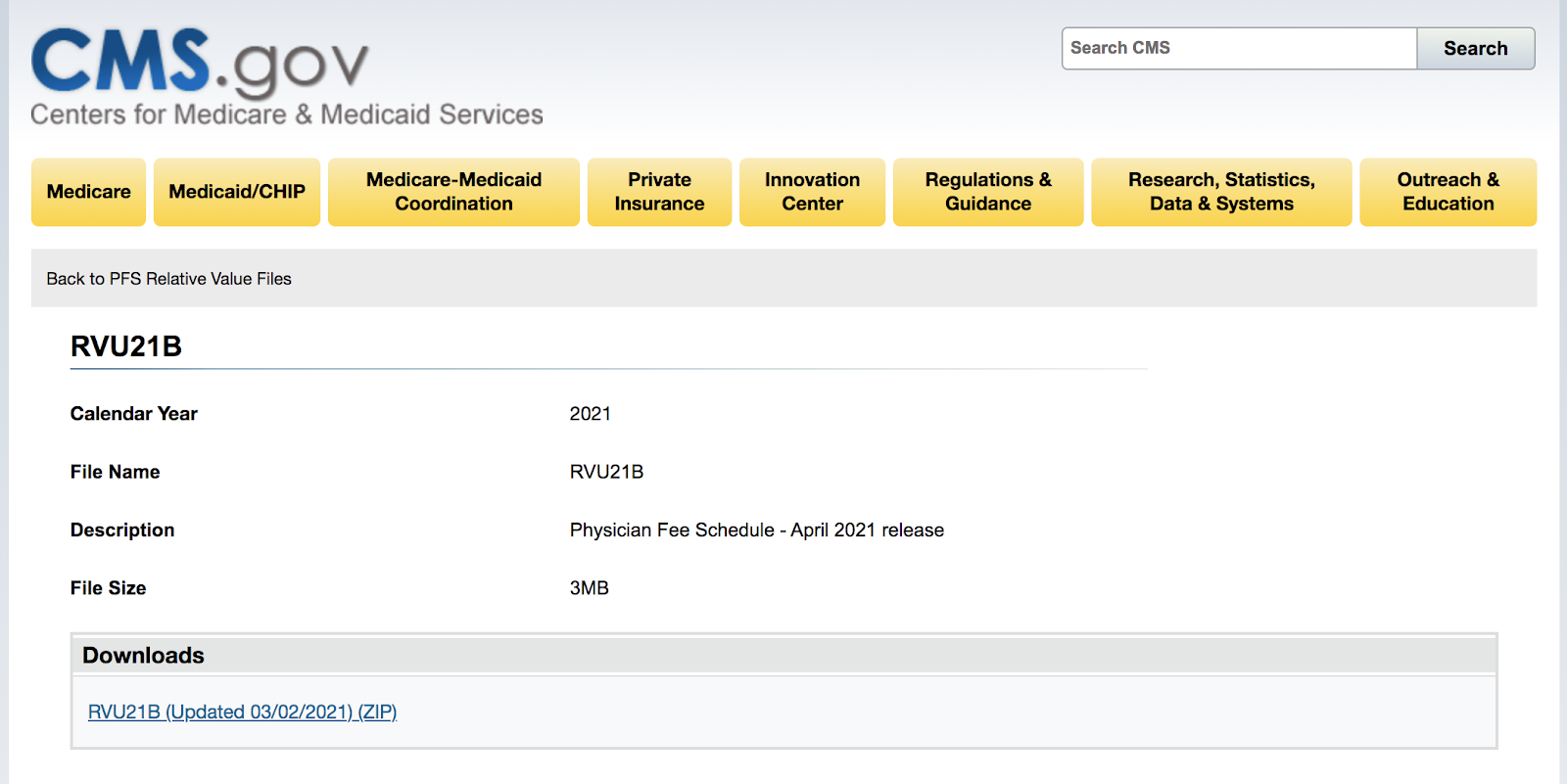

Clicking the link for the most recent RVU file navigates to the Medicare website where you can download the RVUs for procedure codes.

For a complete outline of how to apply the Base Maximum Fee Formula, read our article Reimbursement for Physician Services Rendered on or After January 1, 2019.

Healthcare Common Procedure Coding System (HCPCS)

Medicare assigns each HCPCS / Procedure code four RVU values:

- Work RVUs – Account for the time, technical skill and effort, mental effort and judgment, and stress to provide a service.

- Non-Facility Practice Expense RVUs – For services provided in a physician’s office. Includes clinical staff time and the equipment and supplies typically used during a visit or procedure, as well as a share of the indirect expenses of a physician practice such as administrative staff, building space, and office supplies.

- Facility Practice Expense RVUs – For services provided in a facility, physicians are paid a “facility based” practice expense RVU which excludes the practice expenses provided by the facility.

- Malpractice RVUs – These are generally the smallest component of the RVU values and represent payment for the professional liability expenses.

HCPCS: Healthcare Common Procedure Coding System

- Level I consists of the American Medical Association's Current Procedural Terminology (CPT) and is numeric.

- Level II codes are alphanumeric and primarily include non-physician services such as ambulance services and durable medical equipment. Level II codes represent items and supplies and non-physician services, not covered by CPT codes (Level I).

- Level III codes, also called local codes, developed by state Medicaid agencies, Medicare contractors, and private insurers for use in specific programs and jurisdictions.

Additional Information

daisyBill Resources

Calculating Conversion Factors

Geographic Practice Cost Indices

Webinar: Workers’ Compensation Fee Schedules

daisyBill Solution

Sign up for the daisyBill Work Comp Wizard and start calculating reimbursements in three seconds or less. Click below for a FREE three-day trial and start easy calculations today.

Try the daisyBill

OMFS Calculator