To use the Physician Services Calculator to calculate reimbursements for Physician Services, follow these instructions.

Note: All services rendered on or after January 1st, 2014 are subject to the RBRVS-based Physician Fee Schedule implemented with the passage of Senate Bill 863. As of 1/1/19 the California Physicians Services Fee Scheule is location-based, meaning reimbursement varies based on the place the service is rendered.

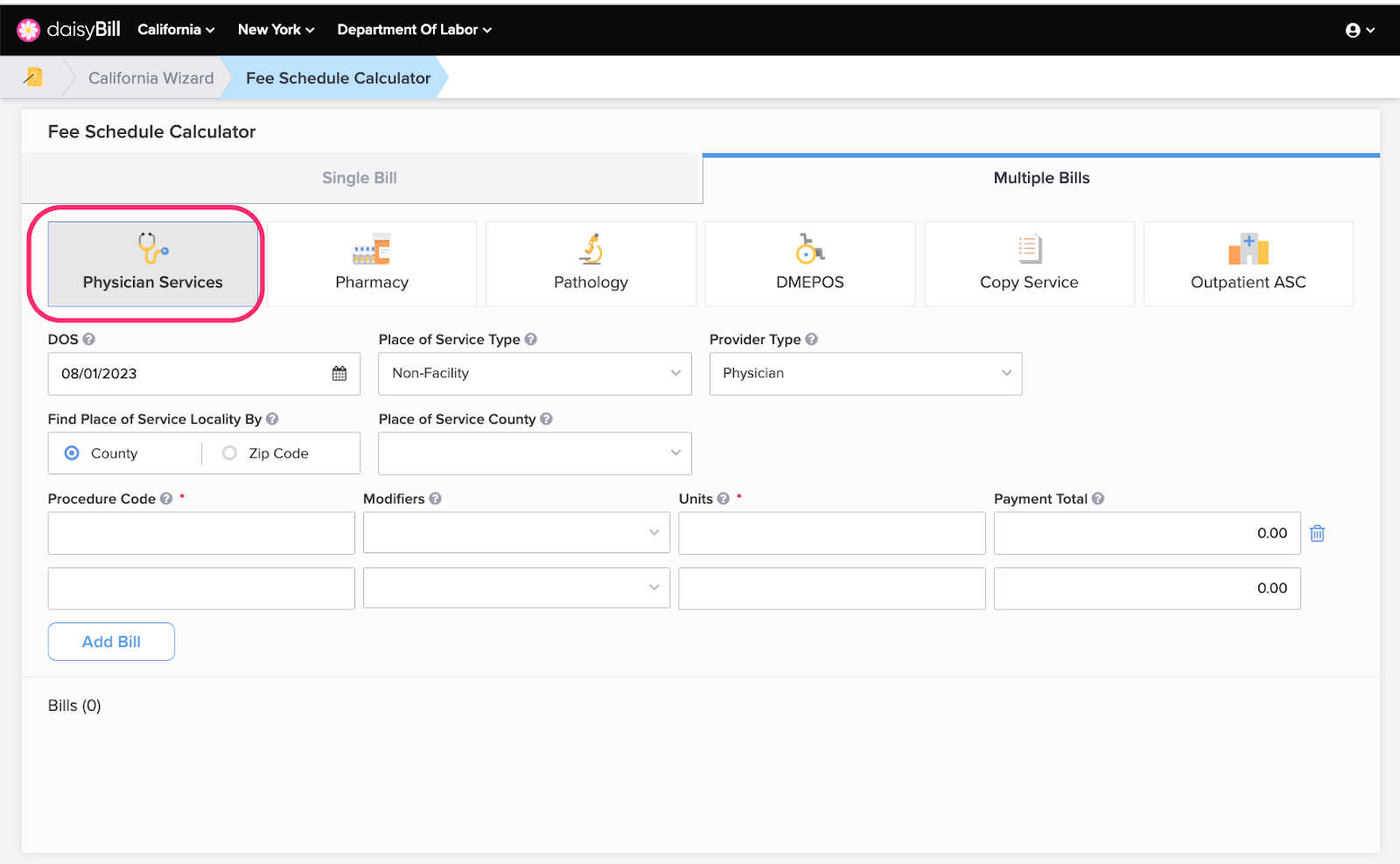

Step 1. Select ‘Physician Services’

On the OMFS Calculator page, Physician Services is automatically selected. Physician services includes calculations for the following services:

- Medical-Legal

- Physician Dispensed DME

- Physician Dispensed Pharmaceuticals (look up using CPT 99070)

- California Specific Reporting Codes

Step 2. Enter ‘DOS’

An accurate OMFS reimbursement amount requires the Date of Service. OMFS reimbursement amounts are calculated using the fee schedule(s) in effect on the date the services were rendered. The Calculator stores historical reimbursement data for dates of service 2005 to present.

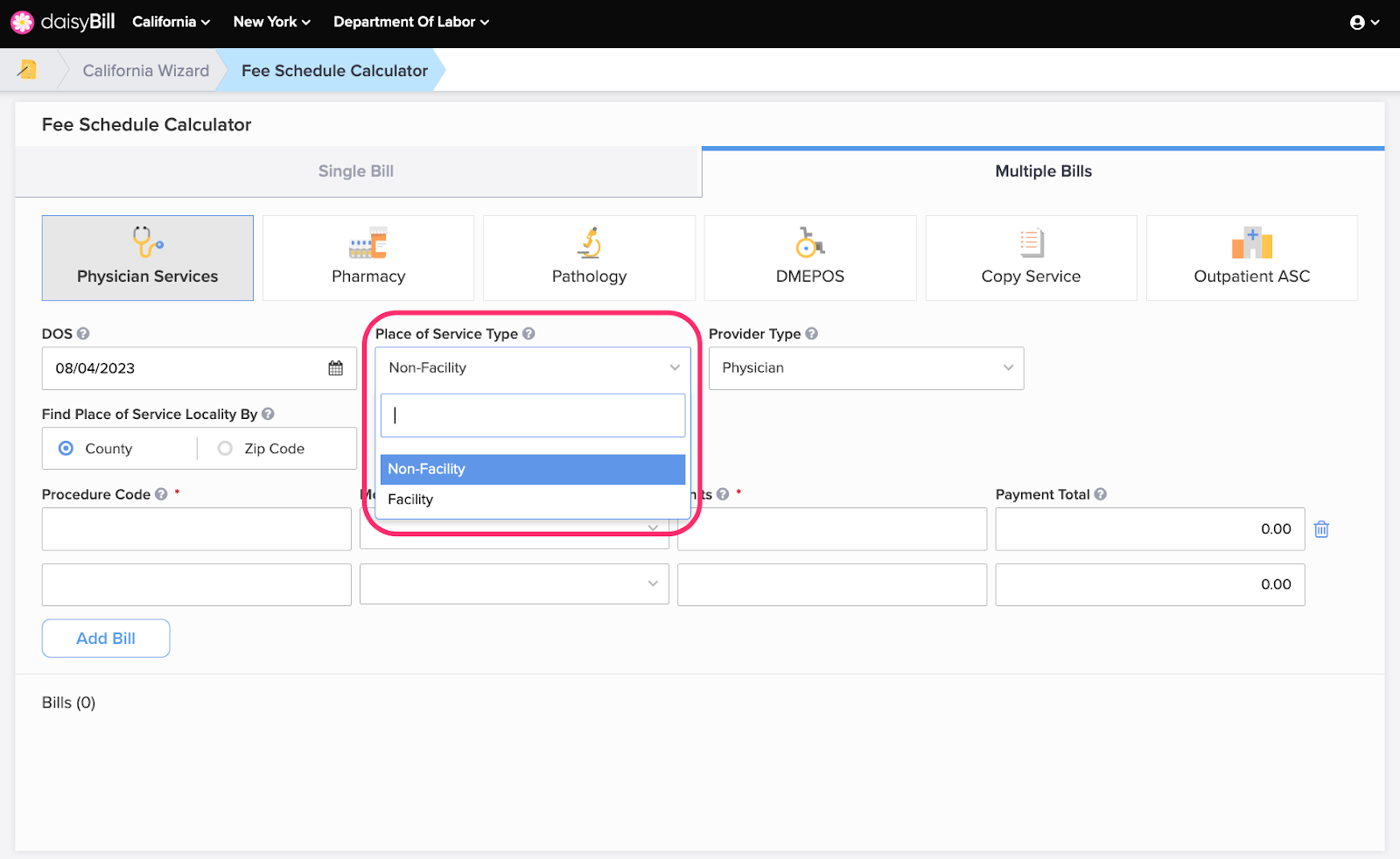

Step 3. Select ‘Place of Service Type’

Effective January 1, 2014 the calculated OMFS reimbursement amount for the Physician Fee Schedule is dependent on the Place of Service type. Choose the Place of Service Type by determining where the face-to-face encounter occurred.

- Non-Facility includes: offices, urgent cares, laboratories, mobile clinics and outpatient rehabilitation centers.

- Facility includes: inpatient and outpatient hospital, ambulatory surgical centers, ambulances, and inpatient rehabilitation facilities.

The DWC provides a crosswalk determine the Place of Service Type. For assistance, see § 9789.12.2. Calculation of the Maximum Reasonable Fee - Services Other than Anesthesia.

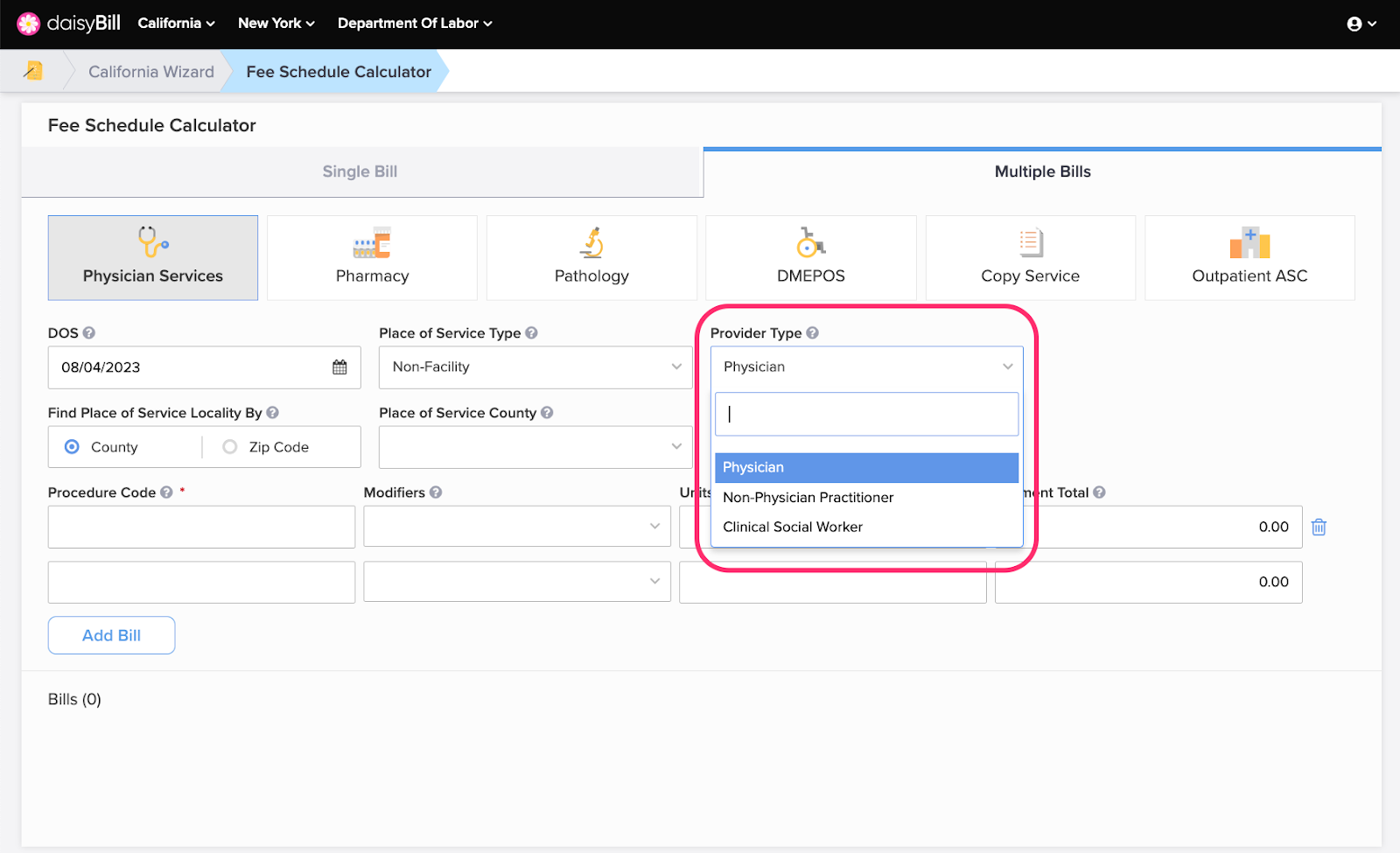

Step 4. Select ‘Provider Type’

Effective January 1, 2014 per § 9789.15.1. Non-Physician Practitioner (NPP) - Payment Methodology the Physician Fee Schedule reimbursement amount is dependent on the Provider Type.

- Physician - reimbursed 100% Physician Fee Schedule.

- Non-Physician Practitioner - reimbursed 85% of the Physician Fee Schedule. Includes: physician assistants, nurse practitioners, clinical nurse specialists.

- Clinical Social Worker - reimbursed 75% of the Physician Fee Schedule.

Reimbursement for services provided by Non-Physician Practitioners (NPPs) employed by a physician that are incident to the physician service are reimbursed at 100% of the physician fee schedule amount as though the physician personally performed the services.

Step 5. Enter Place of Service Locality

For Dates of Service on or after January 1, 2019 California's fee schedule is calculated based on the location where services are rendered (Place of Service, CMS1500 Box 32).

Select County to provide the County where services were rendered. If you cannot find the County, select All Other Counties.

Or, enter the Zip Code of the Place of Service.

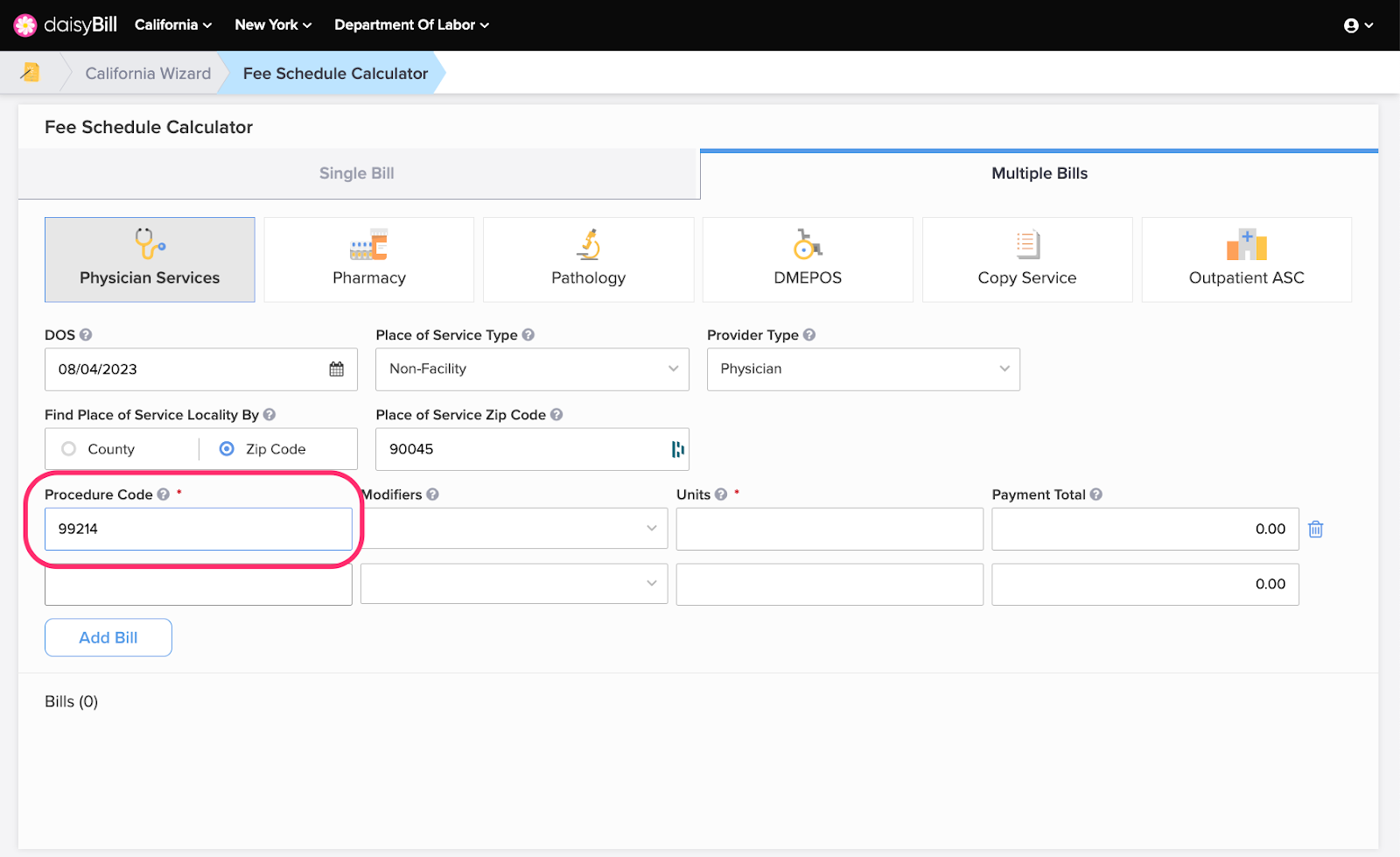

Step 6. Enter ‘Procedure Code’

HCPCS / CPT / California Specific Codes / Medical-Legal Codes that describe services rendered.

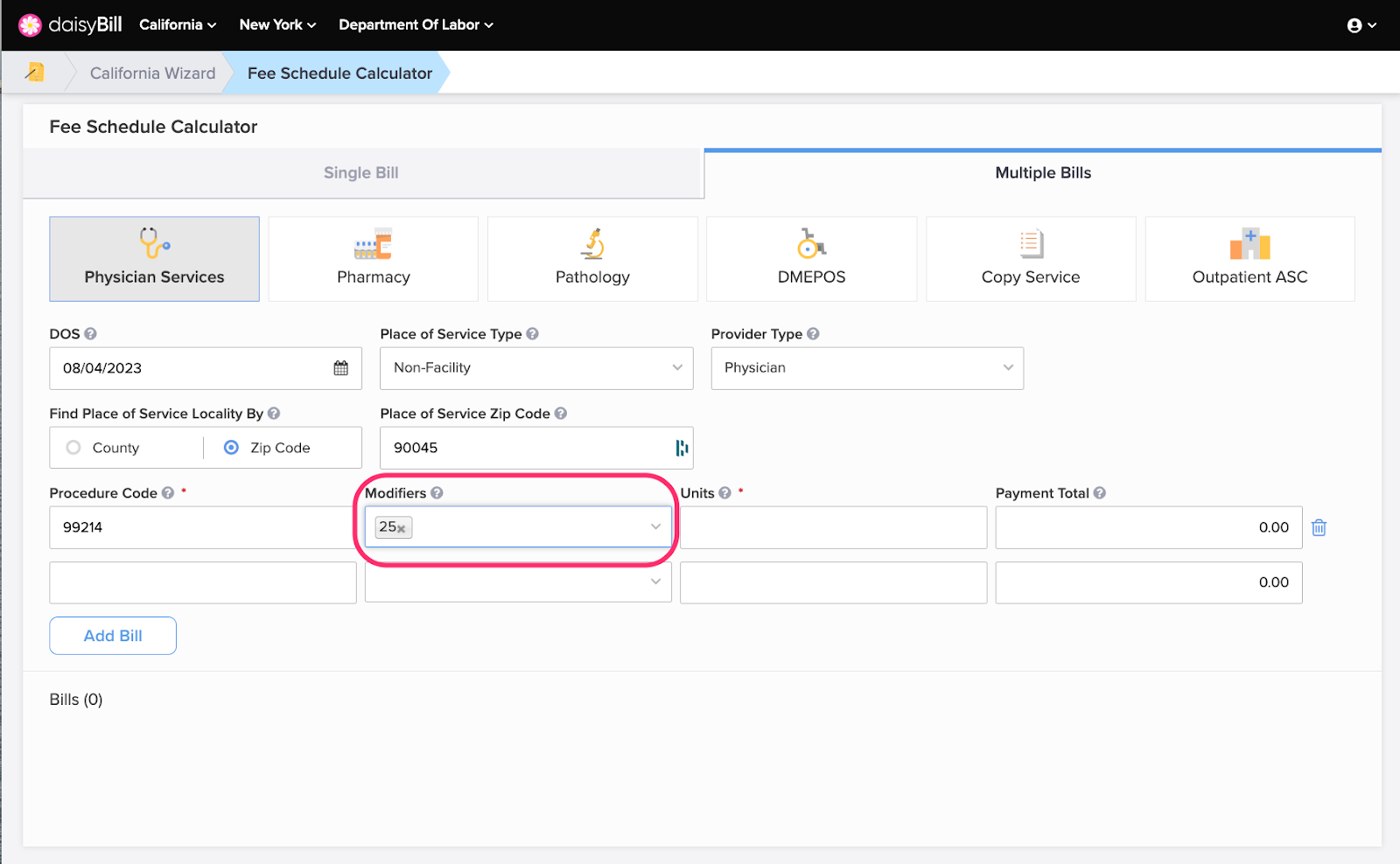

Step 7. Optional: Enter ‘Modifiers’

Enter applicable Modifiers for the Procedure Code. Some Modifiers affect reimbursement calculations (referred to as ‘fee-affecting’ modifiers) or may affect Correct Coding Initiative (CCI) edits.

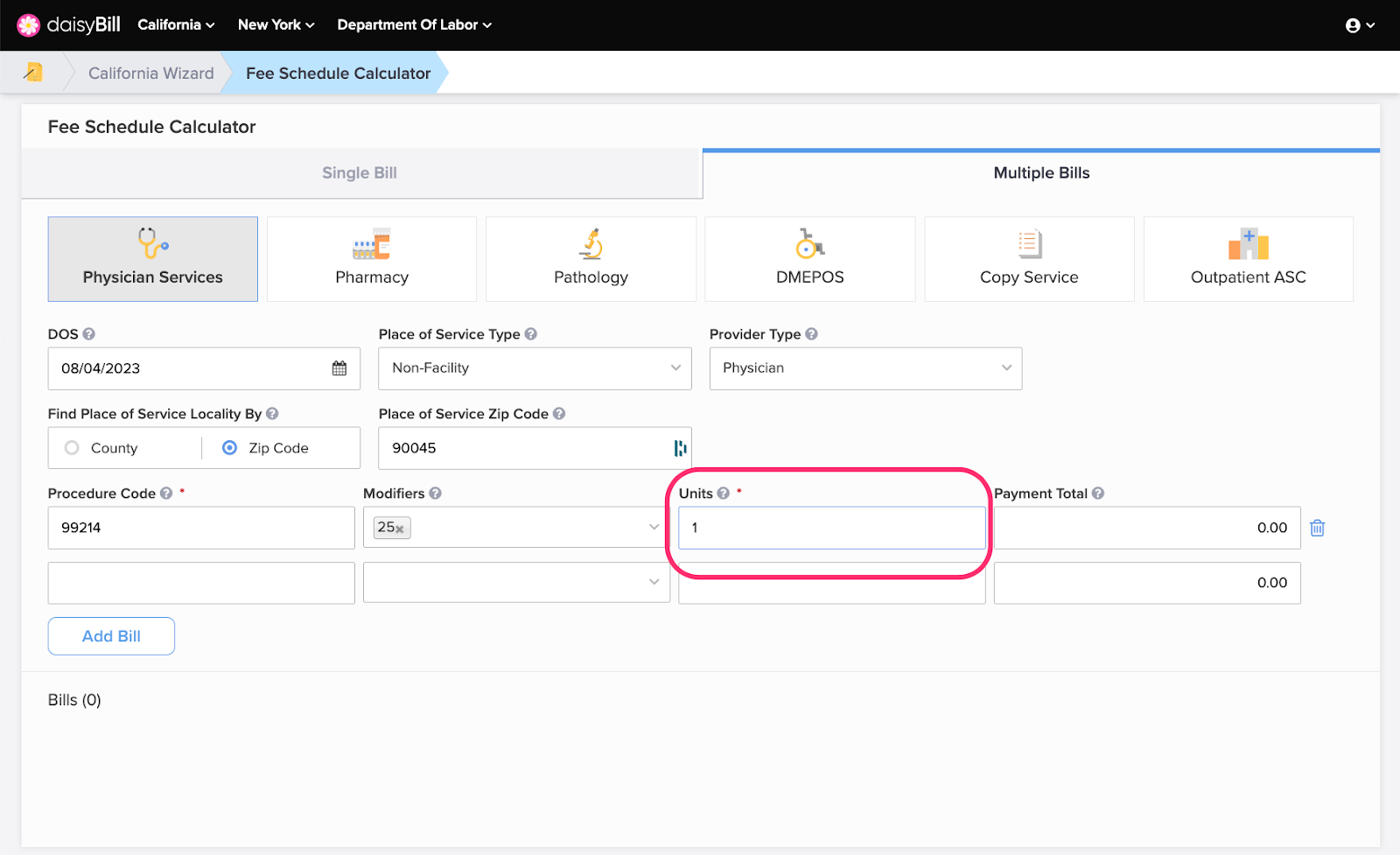

Step 8. Enter ‘Units’

Enter the number of Units to represent the quantity of the Procedure Code. Depending on the Procedure Code, a Unit might represent any of the following: number of report pages, a block of time, number of pills, etc.

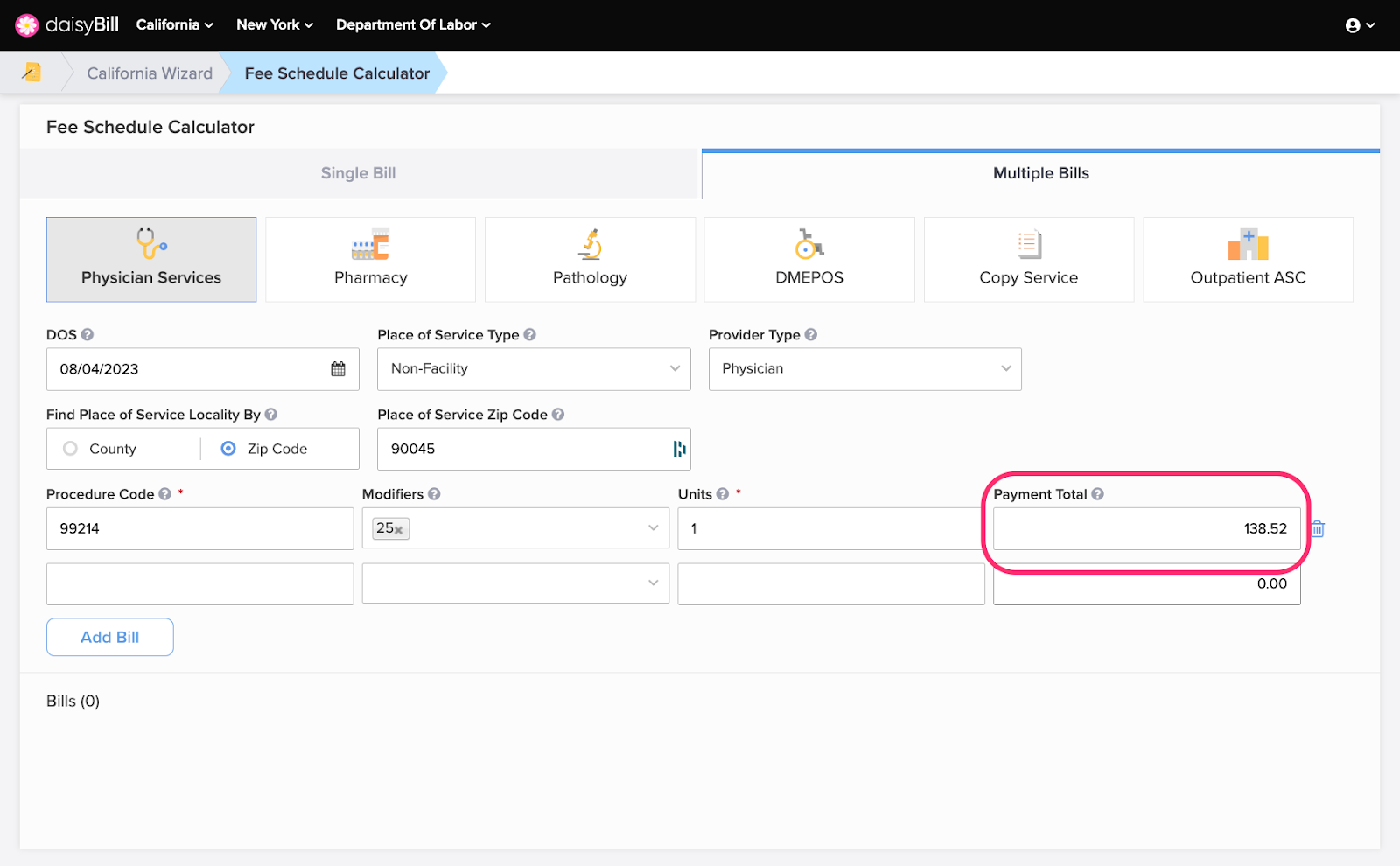

Step 9. Optional: Enter ‘Payment Total’

Enter the reimbursement amount allowed by the claims administrator as reported on an explanation of review (EOR). This optional field defaults to $0. The Payment Total amount is used to calculate the Expected %.

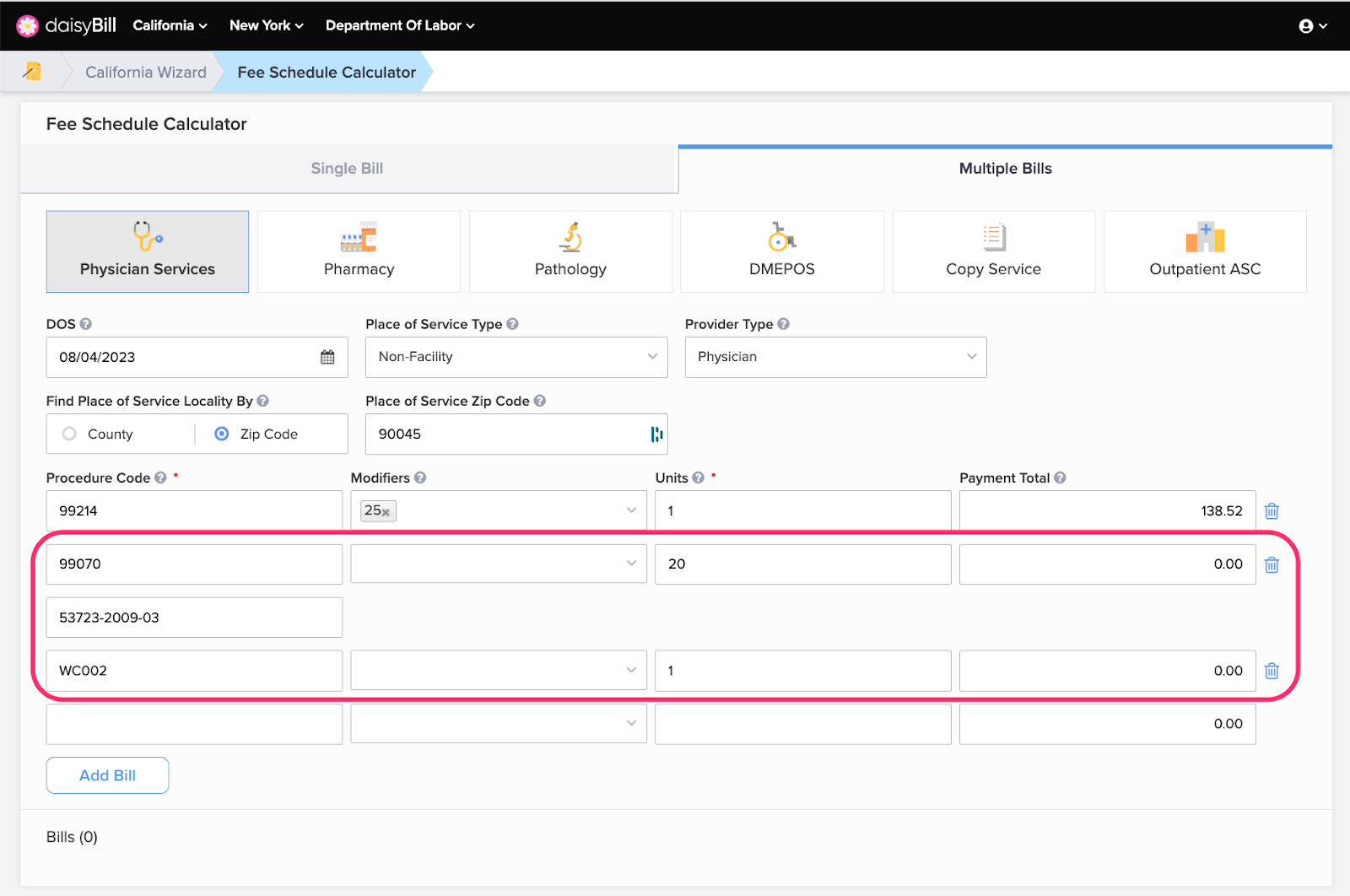

Step 10. Optional: Repeat steps 6-9 for additional Procedure Codes

IMPORTANT: For all dates of service on or after January 1st, 2014, enter all Procedure Codes billed or performed on a single date of service by a single provider. Applicable surgical cascading and Billing Ground Rules (including NCCI Edits and MPPR) are applied to multiple procedure codes.

For physician dispensed pharmaceuticals use Procedure Code 99070 and enter the 11-digit NDC number. For more help looking up physician dispensed pharmaceuticals see the Help Article Physician Services - Dispensed Drugs.

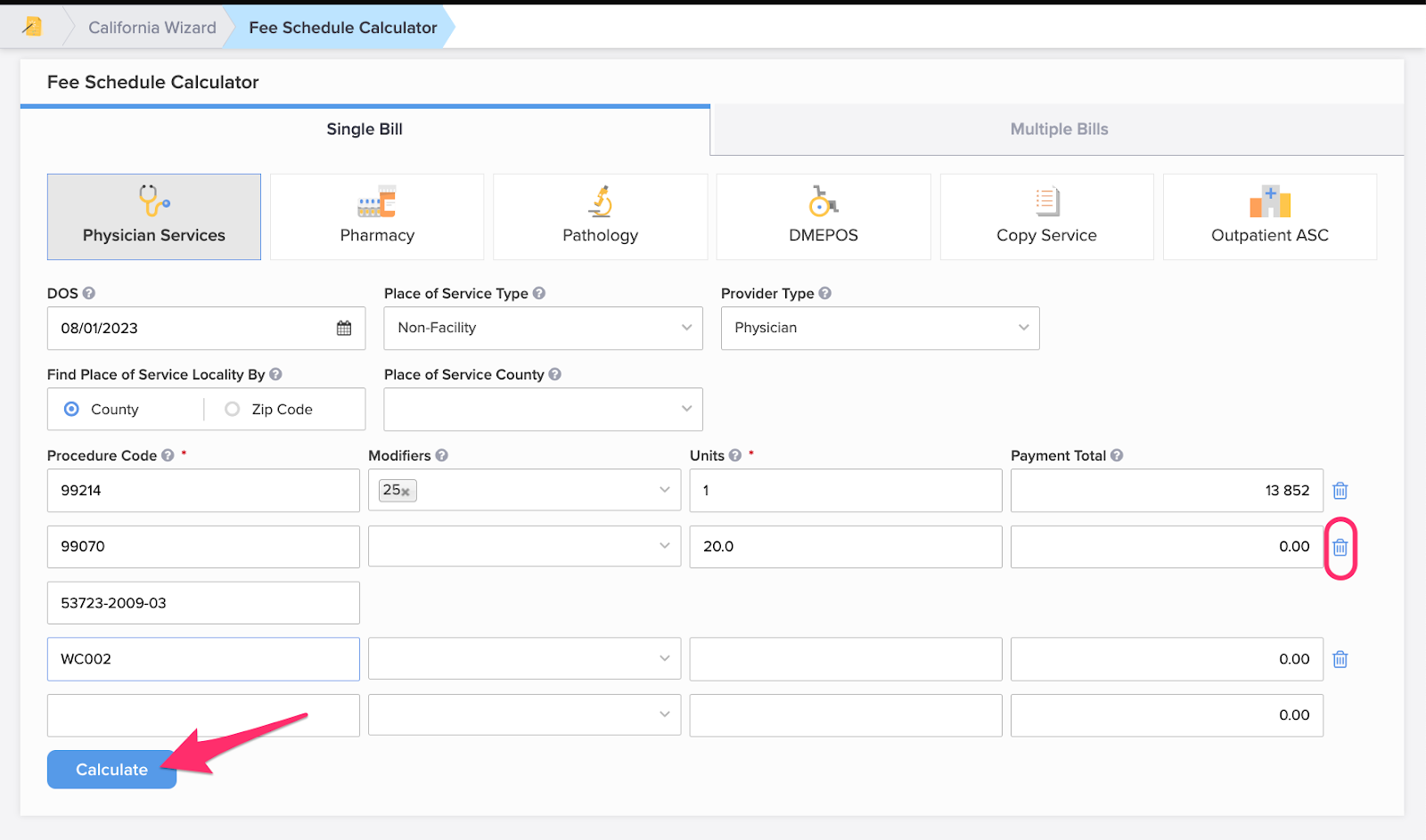

Step 11. Click ‘Calculate’

Click the Trashcan icon to delete a Procedure Code prior to calculation.

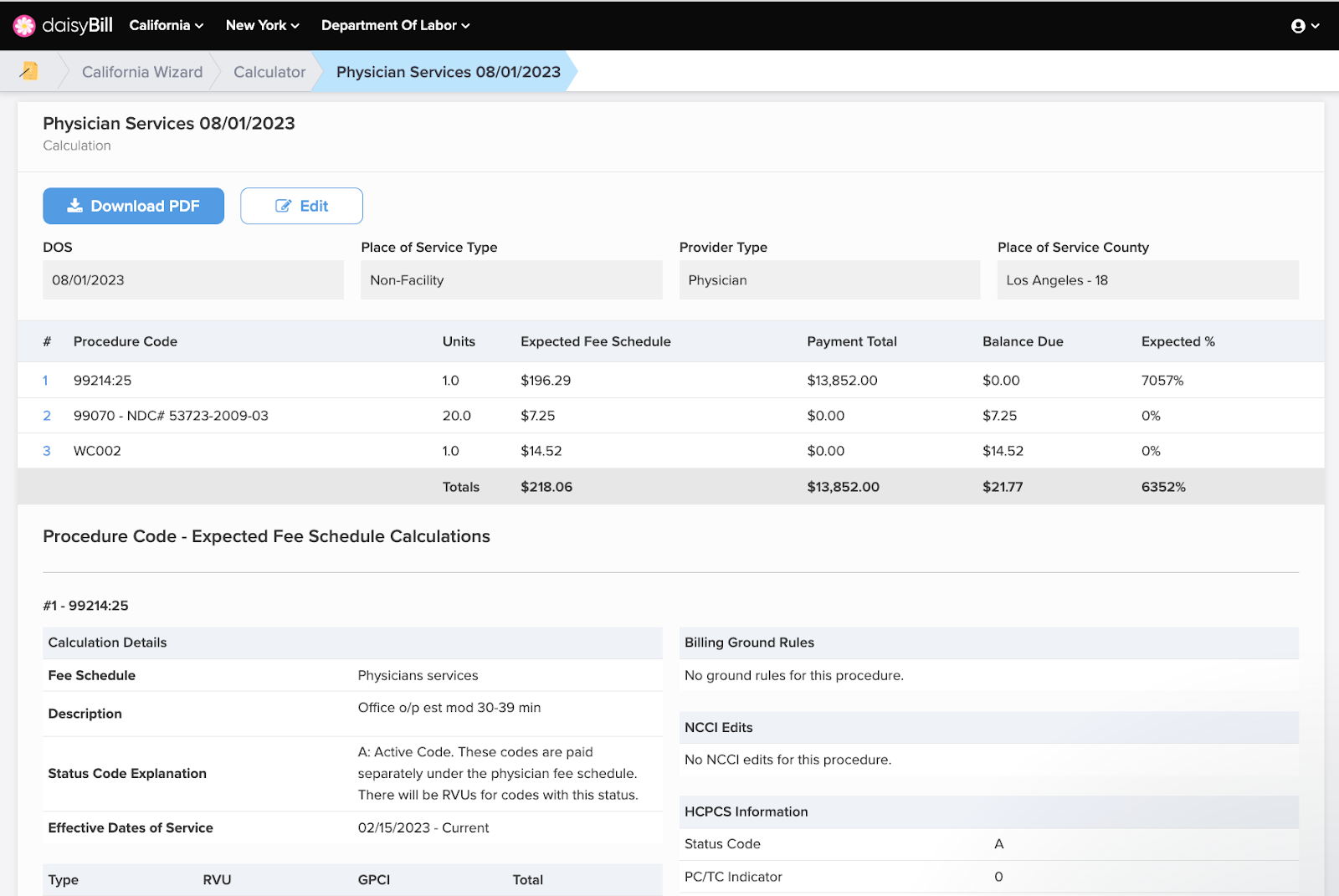

Step 12. View the calculations

For more information on calculations see the Help Article: California Calculator Results Explained.

You’re a daisyBilling pro!